The Latest VC Funds

We take a closer look at the latest VC funds announced since the start of 2024 and explore where the venture landscape is headed next

Welcome back to another edition of NEW ECONOMIES, rooted in my experiences working in venture. From inside the venture world, one thing is clear: we’re not just in a tech boom—we’re living through a full-blown economic rewrite.

Join us on this journey—subscribe to NEW ECONOMIES to stay ahead of the curve in technology. New platforms, business models, and evolving public market strategies are reshaping everything.

THIS WEEK’S SPONSOR: GETRO

The market is volatile. It’s hard to raise funds for both VCs and B2B companies. It’s more important than ever to use your network for cost-efficient growth.

Getro helps you operationalize your network. Get intros to the right people who can help you grow.

Tap into your extended network to: find co-investors, hire the right talent, close more revenue, and diligence deals.

Join 850+ Funds (Accel, Index Ventures, Techstars) and B2B Revenue Teams (Invisible, Compa, Default). Put your network to work with a unified contact database, a warm intros engine, and a job board.

THE STATE OF VENTURE CAPITAL

The venture landscape has undergone a wide range of changes in recent years. Many startups are delaying IPOs, while AI-driven innovation has surged. Nearly 40% of all venture funding now flows to AI-related startups. Valuations are rising across most funding stages, and new funds are being announced almost weekly.

One trend is unmistakable: investors are going all in on AI startups. The key question now is—what comes next and how many of these AI startups will actually make it?

In this edition, we explore the current state of venture and spotlight the funds you should know—specifically those that have actively raised new capital from the beginning of 2024 through today.

WHAT IS HAPPENING ACROSS VENTURE

Since the start of 2024, over 120 firms have announced new funds, with approximately 30% representing first-time vehicles. A few notable trends are emerging:

Solo GPs

Former founders, operators, and investors from established firms are branching out to launch their own funds—a trend we highlighted in our recent edition on active solo GPs.

Investors are now investing from the earliest stages

If investors aren’t active at the pre-seed stage, they’re not at the table—you’re on the waiting list.

AI startups keep raising more and more capital

VCs rush into every emerging category—but few have moved as fast as they have with AI.

Startups have been raising capital at record speeds, with term sheets issued just days after initial discussions. Since Q1 2023, over $220 billion has been invested in AI startups, including nearly $60 billion in the first quarter of this year alone. Let's take a closer look at how much capital has been raised in recent quarters:

Q1 '23 – $16.5B

Q2 '23 – $12.1B

Q3 '23 – $15.0B

Q4 '23 – $13.3B

Q1 '24 – $13.9B

Q2 '24 – $24.8B

Q3 '24 – $22.0B

Q4 '24 – $44.0B

Q1 '25 – $59.6B

Investors are becoming PE houses

Lightspeed Venture Partners, one of Silicon Valley’s leading venture capital firms, has changed its regulatory status by registering as a registered investment advisor (RIA). This move expands its investment capabilities and aligns with similar shifts by Sequoia Capital, Andreessen Horowitz, and General Catalyst, as these firms move beyond the traditional venture capital model. As RIAs, they can now invest more freely in public equities, secondary shares, and cryptocurrencies. By contrast, firms without RIA status are generally restricted to allocating no more than 20% of their capital to investments outside of private startups.

Let’s take a closer look at the most recent firms to launch new funds.

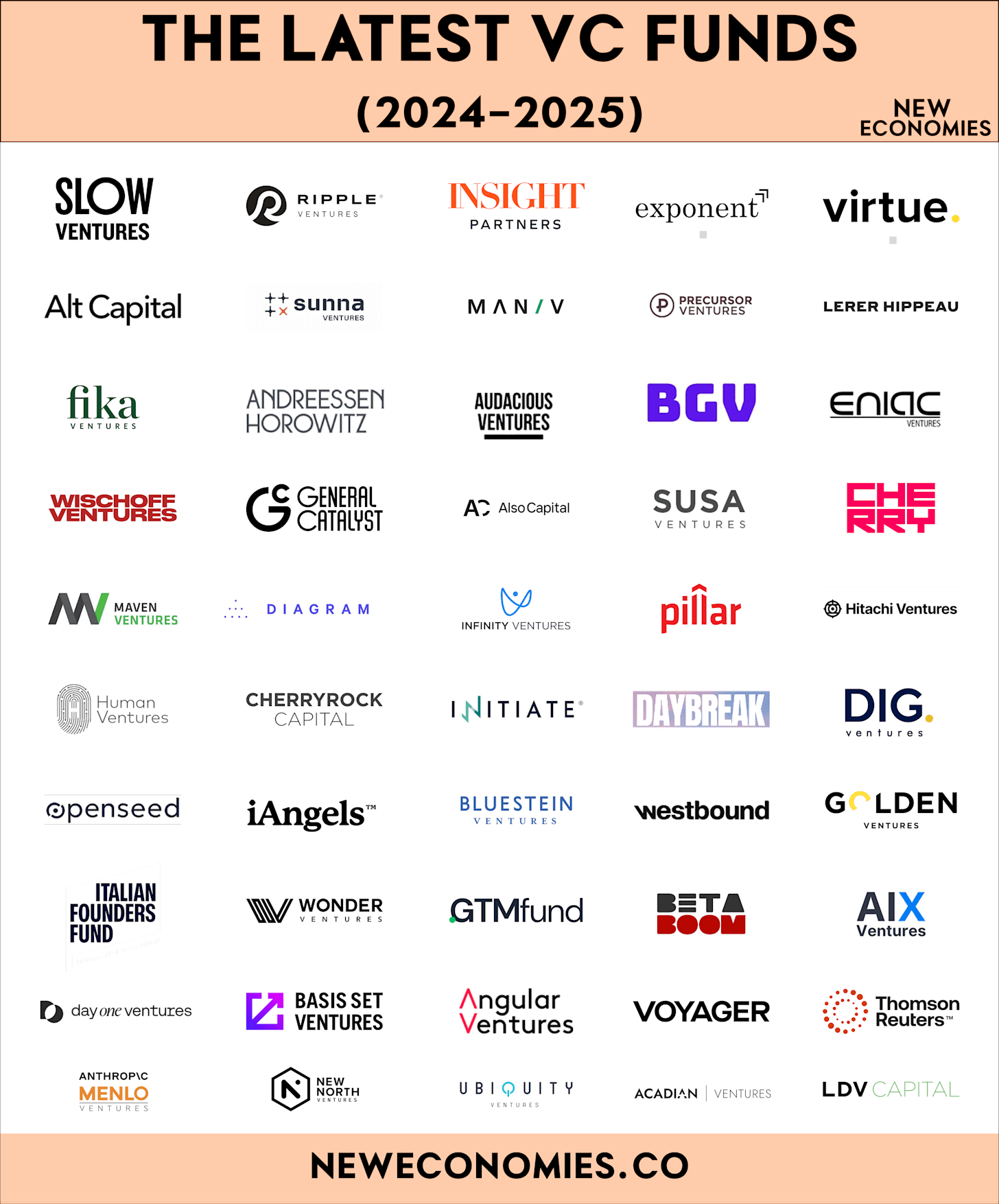

MEET THE LATEST VC FUNDS

Although startups might be finding it harder to raise, VC funds continue to raise capital from LPs.

Since the beginning of 2024, over 120 firms have announced new funds, with 30% being first-time funds. We take a closer look at who they are and their area of focus.

WHAT IS INCLUDED

Names of funds.

Which categories they invest in.

Which geographies they invest in.

Which fund number they are on.

THE CURRENT STATE OF STARTUP FUNDRAISING

Against a backdrop of geopolitical uncertainty and renewed concerns over tariffs and trade tensions, global VC investment rose from $118 billion in Q4’24 to $126 billion in Q1’25, fueled by a wave of mega deals—including eight $1 billion+ transactions and a standout $40 billion raise by OpenAI.

Despite the uptick in investment value, deal volume declined quarter-over-quarter as many VC investors paused to evaluate whether market shifts were temporary and to preserve capital in light of ongoing IPO exit delays. Deal-making also slowed as firms adapted to evolving investment considerations.

PRE-SEED ROUNDS

The median pre-money valuation on primary funding rounds increased over the course of 2024 at every stage from seed through Series C. The lone exception to this upward trend occurred at Series D, where the median pre-money valuation on primary rounds fell 11% from Q4 2023 to Q4 2024.

The number of new primary rounds decreased over this span at both seed and Series A, including a 36% drop in seed-stage activity. At later stages, however, deal counts have increased since the end of 2023—the later the stage, the larger the increase. There were 60% more primary rounds at Series D in Q4 2024 than there were in Q4 2023.

THE RISE OF SOLO GPs

Meet the 60+ Solo GPs who are making waves across the continent. These independent investors are reshaping the venture landscape, leveraging their unique insights, networks, and agility to identify and back the next generation of promising startups.

As solo general partners, they operate with a distinctive edge—combining the deep conviction of personal investment with the flexibility to move quickly and strategically in dynamic markets.

This market map features solo GPs actively investing in early-stage startups, categorized by geography.

THE NEXT WAVE OF GPs

The following GPs are currently rumored to be raising their own funds