The Solo GP Landscape 2025

Inside the Rise of Solo VC's and Their Impact on Startups

Welcome back to another edition of NEW ECONOMIES, rooted in my experiences working in venture. From inside the venture world, one thing is clear: we’re not just in a tech boom—we’re living through a full-blown economic rewrite.

Join us on this journey—subscribe to NEW ECONOMIES to stay ahead of the curve in technology. New platforms, business models, and evolving public market strategies are reshaping everything.

THIS WEEK’S SPONSOR: ARK

Ark is an intuitive technology solution that empowers VC managers to conduct their fund accounting, LP reporting, and fundraising under one platform.

Designed for the evolving needs of emerging and middle-market managers, Ark offers a highly configurable platform that scales with your business while strengthening rapport with LPs.

Whether launching your first fund or managing your fifth—Ark simplifies fund operations and drives efficiency alongside GP-centric, transparent pricing.

To learn more about Ark’s platform and schedule a demo, please click the link below.

THE SOLO GP LANDSCAPE 2025

Over the past few years, the venture landscape has quietly undergone a shift: Solo GPs have become a huge force in early-stage investing.

In 2020, solo GPs were a minority among emerging fund managers. By 2024, they accounted for over half of all new funds—a clear signal that smaller, faster, and more focused capital is reshaping the startup ecosystem.

What’s behind the momentum? Part of it is structural—lower fund sizes, faster deployment, and tighter theses allow solo GPs to outmaneuver traditional teams. But it’s also cultural.

Founders increasingly want to work with investors who speak their language, often fellow operators or former entrepreneurs themselves. And LPs are taking notice, backing individuals with strong networks and specialized insight over big-brand VC firms.

Throughout this edition, we look back at how this shift unfolded, explore the Solo GP landscape, and present data on the current state of venture capital.

WHAT MAKES A GREAT SOLO GP?

Solo GPs are known to move fast. Here are a couple of characteristics that appear to be common amongst them:

Agility and Speed:

One of the unique advantages of solo General Partners (GPs) is their ability to make swift decisions. Unlike traditional venture capital firms, which often have layers of bureaucracy and multiple stakeholders, solo GPs operate independently. This lean structure allows them to evaluate opportunities, conduct diligence, and make investment decisions without waiting for consensus or formal committee approvals. For startups, especially in early stages, this speed can be a significant advantage—enabling them to close funding rounds quickly and maintain momentum.

Hands-On Approach:

Solo GPs are typically more involved with their portfolio companies. Since they manage fewer investments and don’t delegate relationship management to associates or partners, they tend to develop deeper, more personal connections with founders. This can translate to hands-on mentorship, strategic guidance, and access to their networks, delivered with the kind of attentiveness that's hard to come by in larger VC structures. Founders often appreciate having a single, consistent point of contact who understands their business intimately and is available when they need support.

Rich Experience:

Many solo GPs are former entrepreneurs, operators, or tech industry veterans who bring a wealth of relevant experience to the table. This background often makes them particularly empathetic to the founder journey and capable of providing actionable advice based on firsthand knowledge. Their experience also enables them to spot potential pitfalls and opportunities early on, helping founders navigate early-stage decisions more effectively.

Lean Funds:

While solo GPs typically manage smaller pools of capital compared to traditional VC firms, this leaner structure comes with its own advantages. Smaller fund sizes often mean a greater focus on early-stage investments and a willingness to back riskier, more unconventional ideas that might be overlooked by institutional VCs.

MEET THE SOLO GPS

Meet the 60+ Solo GPs who are making waves across the continent. These independent investors are reshaping the venture landscape, leveraging their unique insights, networks, and agility to identify and back the next generation of promising startups.

As solo general partners, they operate with a distinctive edge—combining the deep conviction of personal investment with the flexibility to move quickly and strategically in dynamic markets.

This market map features solo GPs actively investing in early-stage startups, categorized by geography.

FOR THE FULL LIST OF SOLO GPS GLOBALLY, UPGRADE YOUR NEW ECONOMIES SUBSCRIPTION AND BECOME A PAID SUBSCRIBER FOR IMMEDIATE ACCESS.

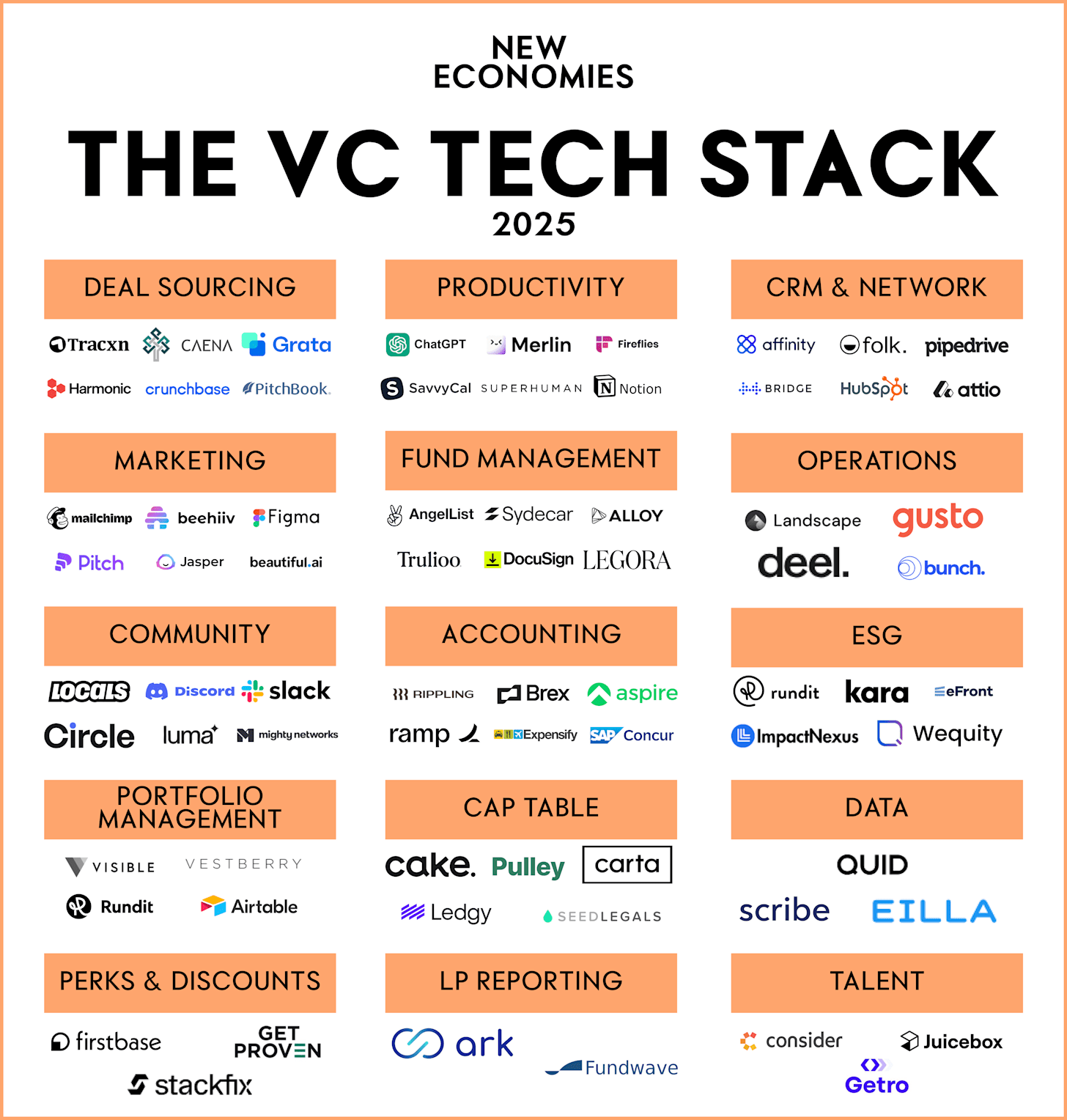

THE VC TECH STACK

An increasing number of partners from top funds—as well as former operators from major tech companies—are breaking off to launch their own firms, a trend we’ve highlighted in previous editions on Startup Factories.

For readers who are preparing to launch their own fund, choosing the right tools to build your tech stack can be pretty complex. Explore our newly published VC Tech Stack Guide which discovers the most up-to-date tools and platforms worth considering to help you launch your fund and to help organize your portfolio companies.

When running a fund, you typically have two key stakeholders: your LPs and your portfolio companies.

We have categorized the tools into the following categories:

Deal Sourcing: Databases made up of startups.

Productivity: Increasing your efficiency.

CRM & Network: Updating your contacts regularly.

Marketing: The go-to tools for running your marketing operations.

Fund Management: Managing your fund and legal matters effectively.

Operations: The day-to-day operations, such as payroll tools.

Community: Keeping your portfolio connected.

Accounting: Tracking your expenses easily.

ESG: Supporting your fund with sustainability measures.

Portfolio Management: Managing your portfolio companies in one place.

Cap Table: Keeping track of fellow co-investors.

Data: Research and data providers.

Perks & Discounts: Platforms that aggregate discounts from leading tech providers.

LP Reporting: Keeping your investors informed.

Talent: Supporting the hiring of the best talent for your portfolio companies.

VC ACTIVITY—WHAT IS HAPPENING

Against a backdrop of geopolitical uncertainty and renewed concerns over tariffs and trade tensions, global VC investment rose from $118 billion in Q4’24 to $126 billion in Q1’25, fueled by a wave of mega deals—including eight $1 billion+ transactions and a standout $40 billion raise by OpenAI.

Despite the uptick in investment value, deal volume declined quarter-over-quarter as many VC investors paused to evaluate whether market shifts were temporary and to preserve capital in light of ongoing IPO exit delays. Deal-making also slowed as firms adapted to evolving investment considerations.