The Hidden Billion-Dollar Market of 'Boring' Business Resurrections

In a world obsessed with unicorns, IPOs, and venture-backed moonshots, a parallel universe of wealth creation has been quietly thriving in the shadows: the realm of "boring" business resurrections

Welcome back to another edition of NEW ECONOMIES, rooted in my experiences working in venture. From inside the venture world, one thing is clear: we’re not just in a tech boom, we’re living through a full-blown economic rewrite. New platforms, new business models, and evolving public market strategies are reshaping everything.

Join us on this journey. Subscribe to NEW ECONOMIES to stay ahead of the technology trends shaping tomorrow. We’re only getting started.

This week’s partner: Fireflies

Fireflies.ai helps millions of people unlock the knowledge buried inside conversations every day. Serving 20+ million people and 500,000+ organizations, Fireflies has processed over 2 billion meeting minutes (nearly 4,000 years' worth) with users at 75% of Fortune 500 companies. Fireflies provides enterprise-grade security with private storage options and never uses customer meeting data to train its AI models.

Go beyond note-taking. Automatically generate emails, write reports, analyze conversations, create scorecards, and turn meetings into actions with 200+ role-specific Fireflies AI Apps.

In a world obsessed with unicorns, IPOs, and venture-backed moonshots, a parallel universe of wealth creation has been quietly thriving in the shadows: the realm of "boring" business resurrections.

While Silicon Valley chases the next TikTok or OpenAI, a growing cadre of savvy operators and investors are amassing fortunes by modernizing the decidedly unsexy businesses that form the backbone of the American economy.

Throughout this edition, we cover the following trends:

The Great Wealth Transfer

The Solo Capitalist Approach

The Rollup Strategy

The Dark Side of "Boring"

1. The Great Wealth Transfer: America's $10 Trillion Opportunity

"I'd rather own a portfolio of laundromats than the next hot software startup," says Codie Sanchez, founder of Contrarian Thinking and managing partner at Unconventional Acquisitions.

With over 500,000 newsletter subscribers hanging on her every word, Sanchez has become the de facto face of what she calls "boring cash flow businesses."

Her thesis is deceptively simple: acquire overlooked, undervalued small businesses with steady cash flows, apply modern technology and management practices, and watch your return on investment drastically outperform traditional assets.

The numbers back her up. While venture-backed startups have an approximate 90% failure rate, many of these "boring" business acquisitions can reportedly return 25-100% annually on invested capital, with much lower risk profiles.

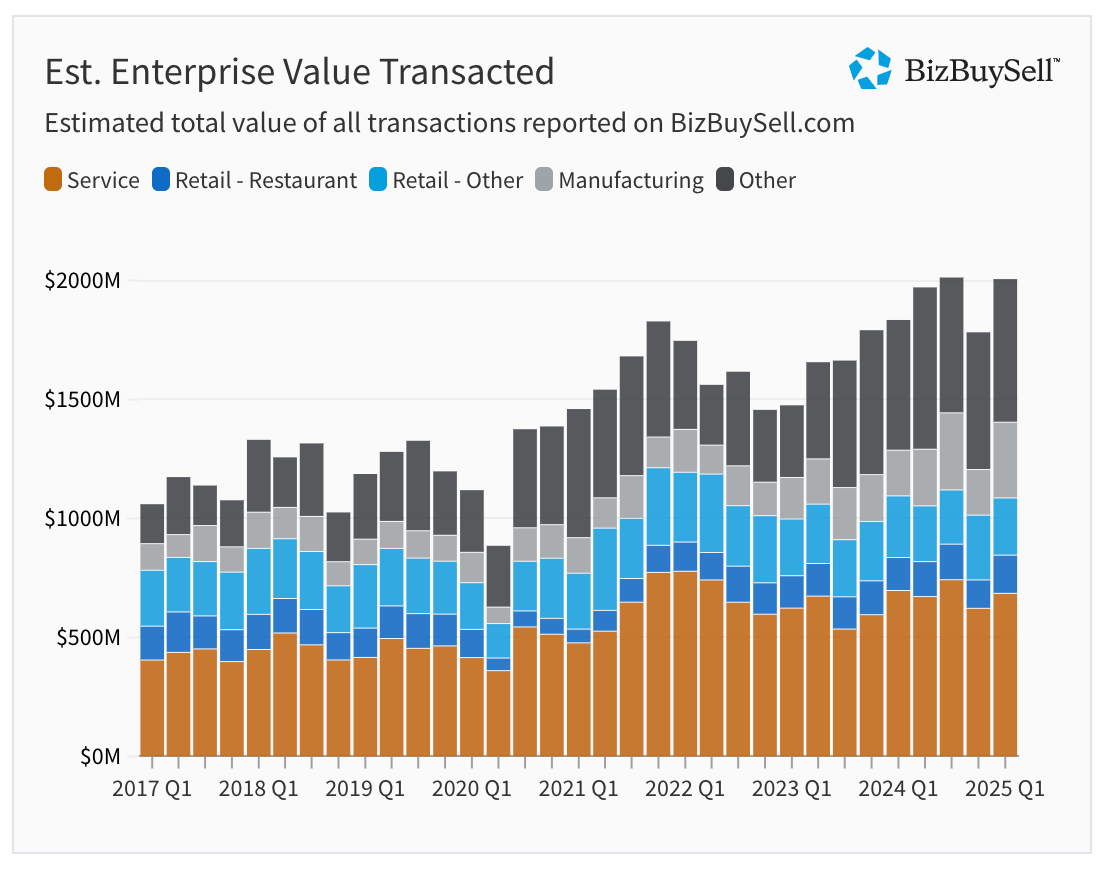

What makes this market particularly compelling now is timing. America is in the midst of what some call the "Great Wealth Transfer," with baby boomer business owners looking to retire en masse. According to a recent report, nearly 10,000 small businesses change hands every quarter in the U.S. alone, with millions more expected to hit the market in the coming decade.

Andrew Wilkinson, co-founder of Tiny Capital, which has quietly built a portfolio of over 30 businesses ranging from design agencies to e-commerce operations, agrees with Codie and believes now is the perfect time to invest in the laundromat, the dentistry firm or the plumbing company.

Why? Because you have aging owners who built successful businesses in the pre-internet era, combined with new operators who understand how to leverage technology to streamline operations and scale these traditional models.

2. The Solo Capitalist Approach: From Zero to Empire

Pushed forward by operators like Codie Sanchez and Alex Hormozi this approach focuses on smaller acquisitions ($500K-$5M purchase price) funded through SBA loans, seller financing, or small syndicates of investors.

The solo capitalist typically acquires one business at a time, improves operations, installs management, and then moves on to the next acquisition while maintaining ownership.

The beauty of this approach is you can start small and scale. Some people might start with their first laundromat for $100K and eventually own portfolios worth tens of millions.

What makes this approach so powerful is the capital efficiency. Where a typical startup might burn through millions before finding product-market fit, these solo capitalists can acquire cash-flowing assets from day one.

When looking at acquiring these traditional businesses, successful investors typically target operations:

With healthy profit margins (typically 15%+)

Showing multiple years of consistent performance

Where implementing better systems can remove operational bottlenecks

That can benefit from straightforward technology upgrades

So, for example: a former software developer purchased a pool servicing company for $850,000 using an SBA loan with 10% down.

Within 18 months of implementing scheduling software, digital marketing, and a customer portal, monthly revenue increased by 65% while reducing labor costs.

The business now generates over $400,000 in annual profit on an initial investment of just $85,000. This pattern of tech-enabled improvements driving outsized returns is repeating across various service businesses nationwide.

3. The Rollup Strategy: When 1+1=3

For businesses like dental practices, veterinary clinics, or HVAC companies, economies of scale create compelling rollup opportunities.

Operators acquire multiple similar businesses in a geographic region, centralize back-office functions, standardize operations, and leverage increased purchasing power.

The operational advantages become clear at scale because once a company owns multiple locations, they can implement sophisticated marketing strategies, deploy better technology systems, and hire specialized staff that would be financially impractical for any single location to maintain on its own.

Where is this happening right now? Practically everywhere:

Car washes (Mister Car Wash: 300+ locations)

Self-storage facilities (Public Storage: 2,500+ locations)

Veterinary practices (VetCor: 400+ locations)

Eye care centers (MyEyeDr: 800+ locations)

HVAC service companies (HomeServe: 4.8M customer contracts)

4. The Technology Arbitrage: Bringing Main Street into the Digital Age

What turns these "boring" acquisitions into wealth-creation vehicles isn't just financial engineering, it's the application of modern technology to businesses that have typically underinvested in digital branding.

Take freight brokerage, a $200+ billion industry in the U.S. alone. Traditional brokers operate with paper manifests, phone calls, and fax machines. Forward-thinking acquirers are implementing digital management systems, automated load-matching algorithms, and mobile apps for drivers—instantly boosting margins while improving service quality.

Or consider local service businesses like plumbing companies, where implementing basic customer relationship management systems, digital marketing, and online booking can double revenue within months.

These aren't complex AI systems or blockchain implementations—they're often just basic digital tools that most tech professionals take for granted: