Is Consumer Social M&A Dead?

A deep-dive on acquisitions by social platforms since 2007. Has the buying spree cooled?

Welcome to NEW ECONOMIES, where we decode the technology trends reshaping industries and creating new markets. Whether you're a founder building the future, an operator scaling innovation, or an investor spotting opportunities, we deliver the insights that matter before they become obvious. Subscribe to stay ahead of what's next alongside 75,000 others.

P.S. When you subscribe, you automatically access these best-in-class AI tools for free — for 12 months.

This week’s guest post

James Creech is the Founder of Quartermast Advisors, an M&A advisory firm that helps entrepreneurs navigate every step of the M&A process and maximize their exit outcomes. Quartermast produces regular reports on M&A activity across digital media, tech, and the creator economy.

Throughout this edition, we cover the current state of M&A activity happening across social platforms.

In this edition, you will learn 👇

The current state of M&A activity across social platforms

The current technology shifts

Macroeconomic Conditions

Political Climate

Largest Acquisitions

Winners and Losers

What comes next?

P.S. If you are interested in the wider creator economy, read our previous reports here.

Let’s dive in 🚀

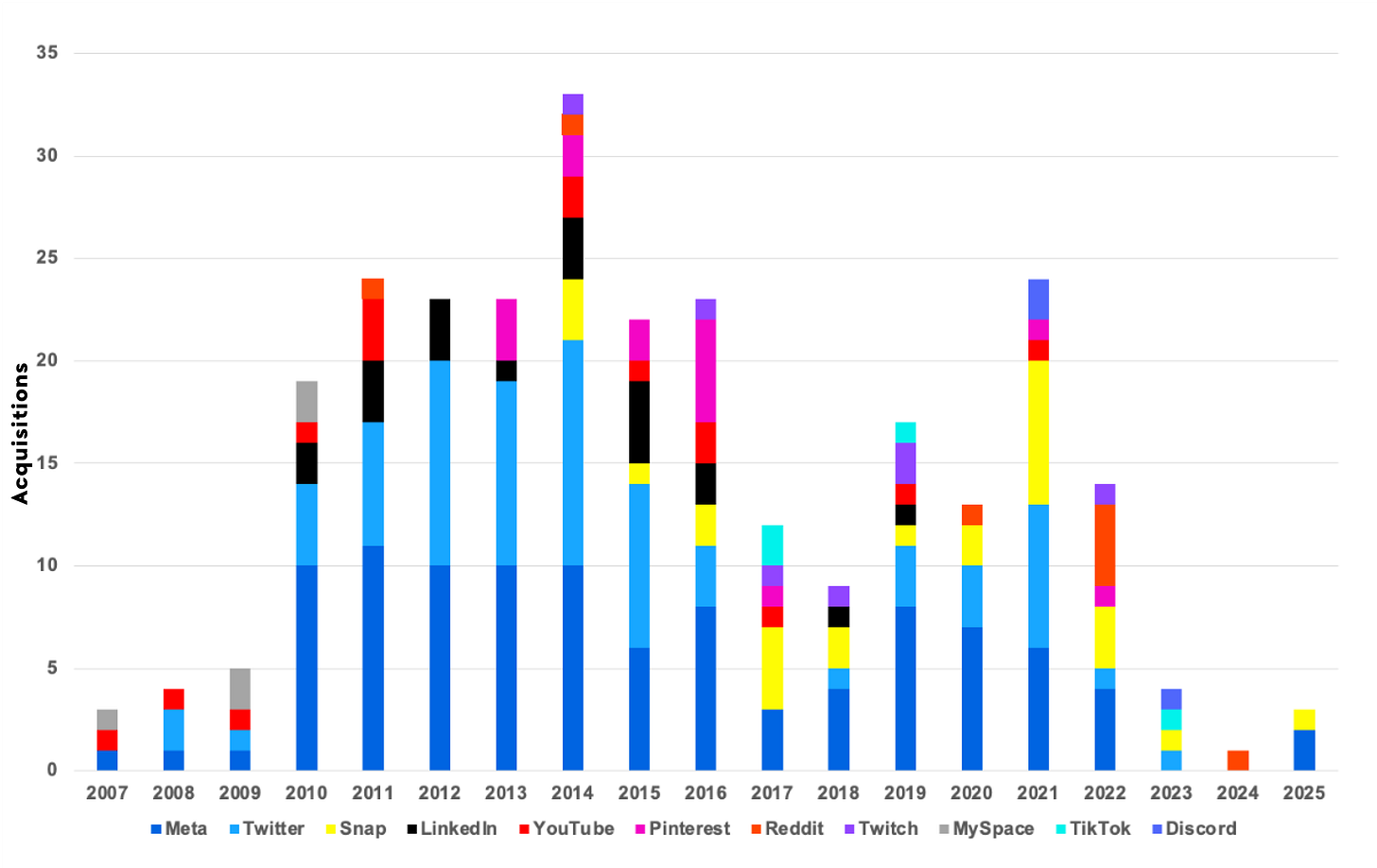

Acquisitions by social platforms (2007 - Present)

In the 2010s, social media platforms were some of the most aggressive acquirers in tech. For years, acquisitions were the fastest way to capture new audiences, add features, and fend off competition.

But if you look at the last five years, the buying spree has cooled. Why?

Technology Shifts

Social platforms rose to prominence in the cloud and mobile eras, as more people came online and new technologies unlocked richer capabilities. New entrants that took advantage of these technology shifts were quickly acquired, e.g. photo sharing (Instagram), short-form video (Vine, Musically), and live streaming (Periscope).

As the market matured, social platforms amassed billions of users and built out robust feature sets, so there are fewer “must-have” startups to buy.

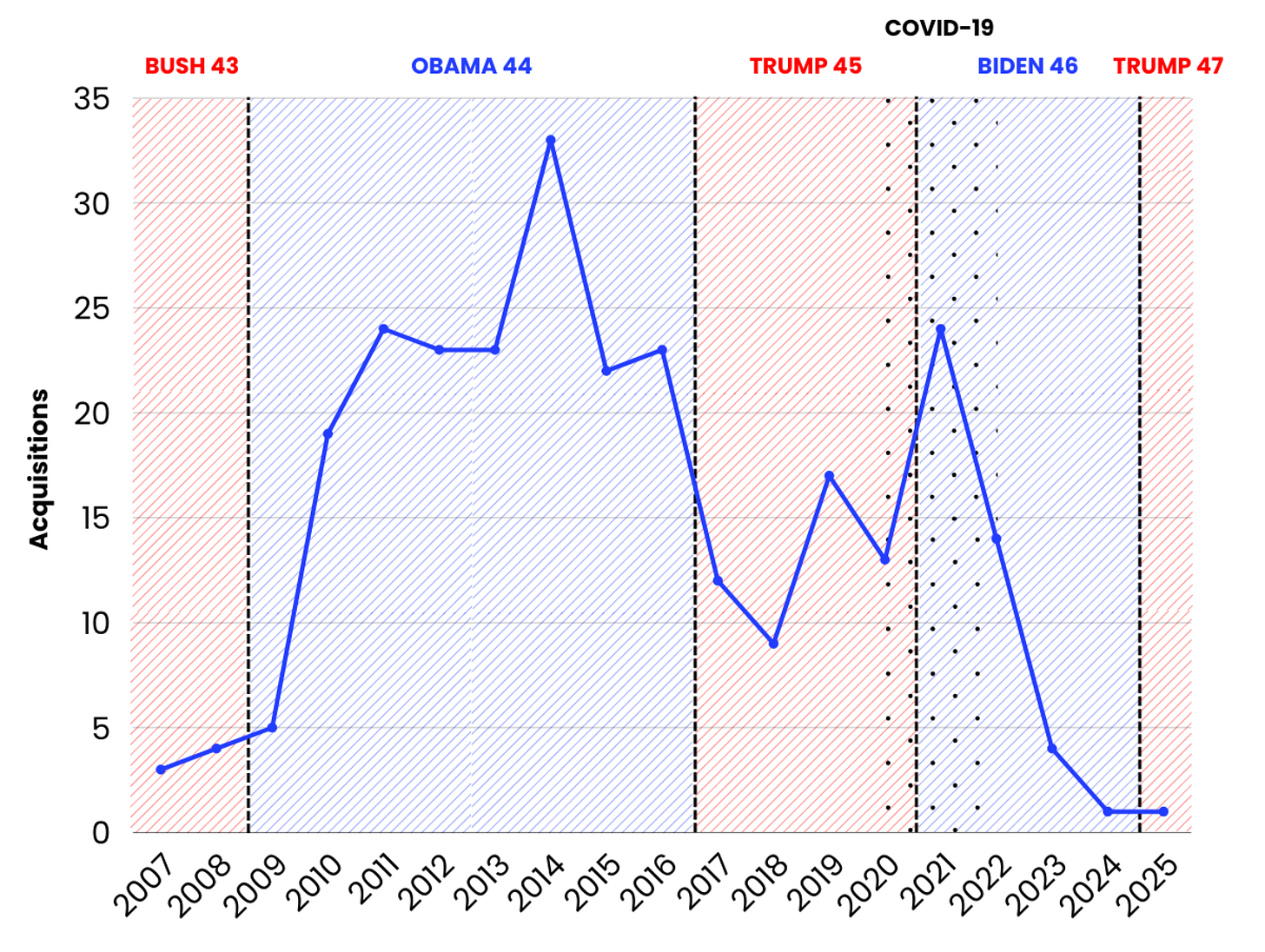

Macroeconomic Conditions

Macroeconomic factors also played a role. Social platforms have historically been most acquisitive when the cost of capital is low, but as interest rates rise, capital becomes more expensive, valuations adjust, and boardrooms grow more cautious.

The chart below, which plots acquisition activity against the U.S. Federal Funds Effective Rate, makes this relationship clear: periods of easy money coincide with surges in M&A, while tighter monetary policy tends to cool the deal-making environment.

Political Climate

Regulatory pressure and antitrust scrutiny of Big Tech has made some acquisitions harder to justify and slower to approve. For example, Meta’s attempted purchase of Giphy faced pushback in both the U.S. and U.K., setting a precedent for future deals.

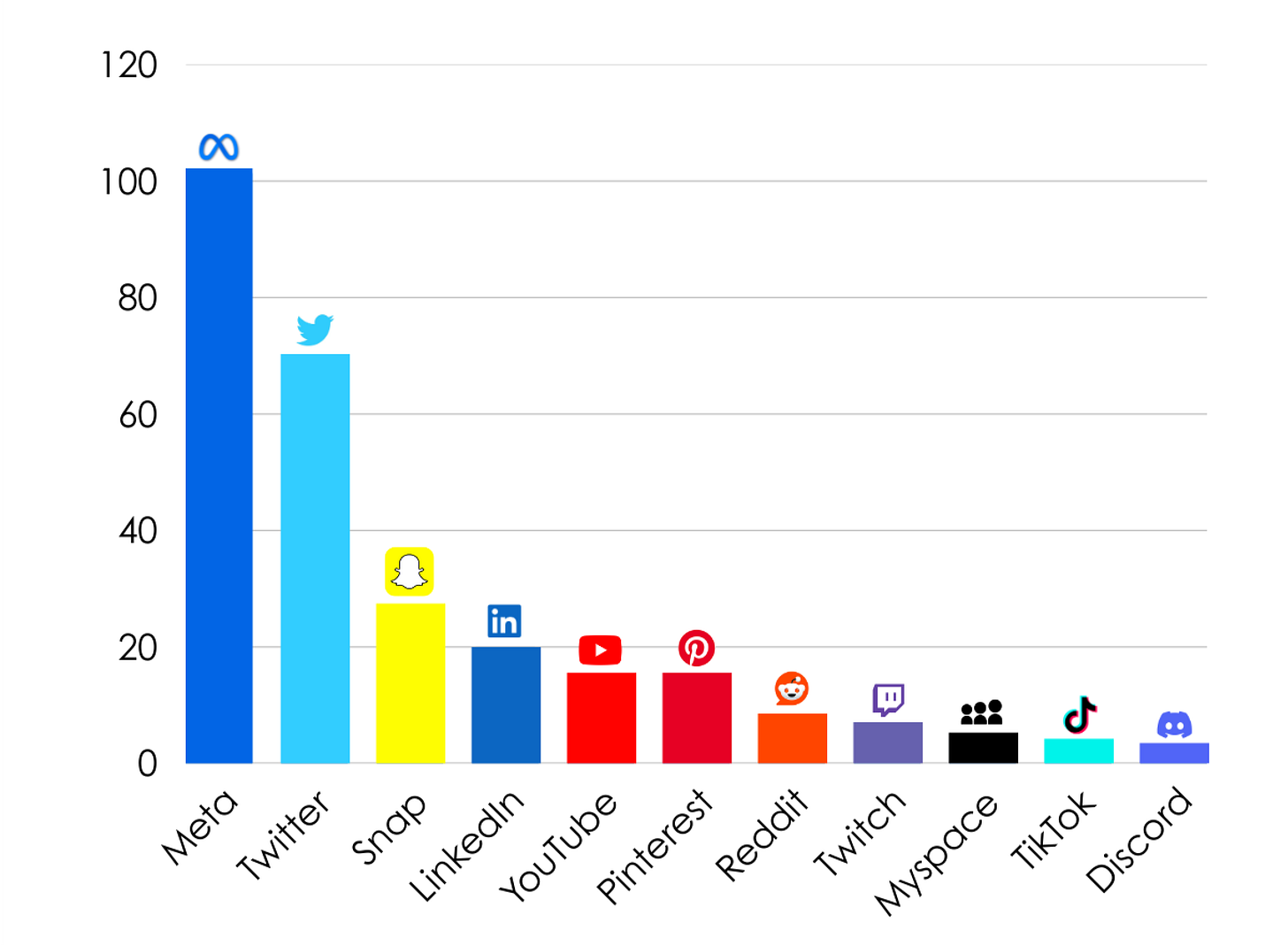

Deals by platform

Meta has been the most acquisitive, placing strategic bets on other social platforms (Instagram), messaging (WhatsApp), metaverse and VR (Oculus), and more recently AI startups (PlayAI). Twitter (now X) has been the second most active, followed by Snap, LinkedIn, and YouTube.

Largest Acquisitions

Discover the largest acquisitions, valuations and when they were acquired.

Winners and Losers

Here’s a look at the most successful acquisitions and biggest misses.

What comes next?

Social platforms will still pursue acquisitions, but the frenzied deal-making of the 2010s is behind us. Today’s environment reflects a new normal — one defined by a more mature growth phase, tighter economics, and increased regulatory scrutiny.

That said, here are a few interesting trends to keep an eye on:

1) New social platforms on the rise.

Kick emerged as a Twitch alternative by offering looser moderation, support for online gambling, and better creator economics.

Threads is leveraging Instagram’s scale to compete head-on with X (formerly Twitter).

Meanwhile, decentralized networks like Bluesky and Mastodon are carving out a different vision for social media, where community governance replaces centralized control.

2) The fight for short-form video dominance.

As the fate of TikTok in the U.S. hangs in the balance, a wave of short-form video startups like Lemon8, RedNote, and Clapper are vying for attention. Add in the continued growth of YouTube Shorts, Instagram Reels, and Snapchat Spotlight, and short-form video continues to be the most hotly contested social battleground.

3) AI as a platform layer.

Tech giants are rapidly pursuing an AI future. Google’s Gemini, Meta’s Llama, and xAI’s Grok are all being built with social applications in mind. From smarter moderation to more robust creative tools, AI will increasingly shape the way we interact online.

Research Methodology

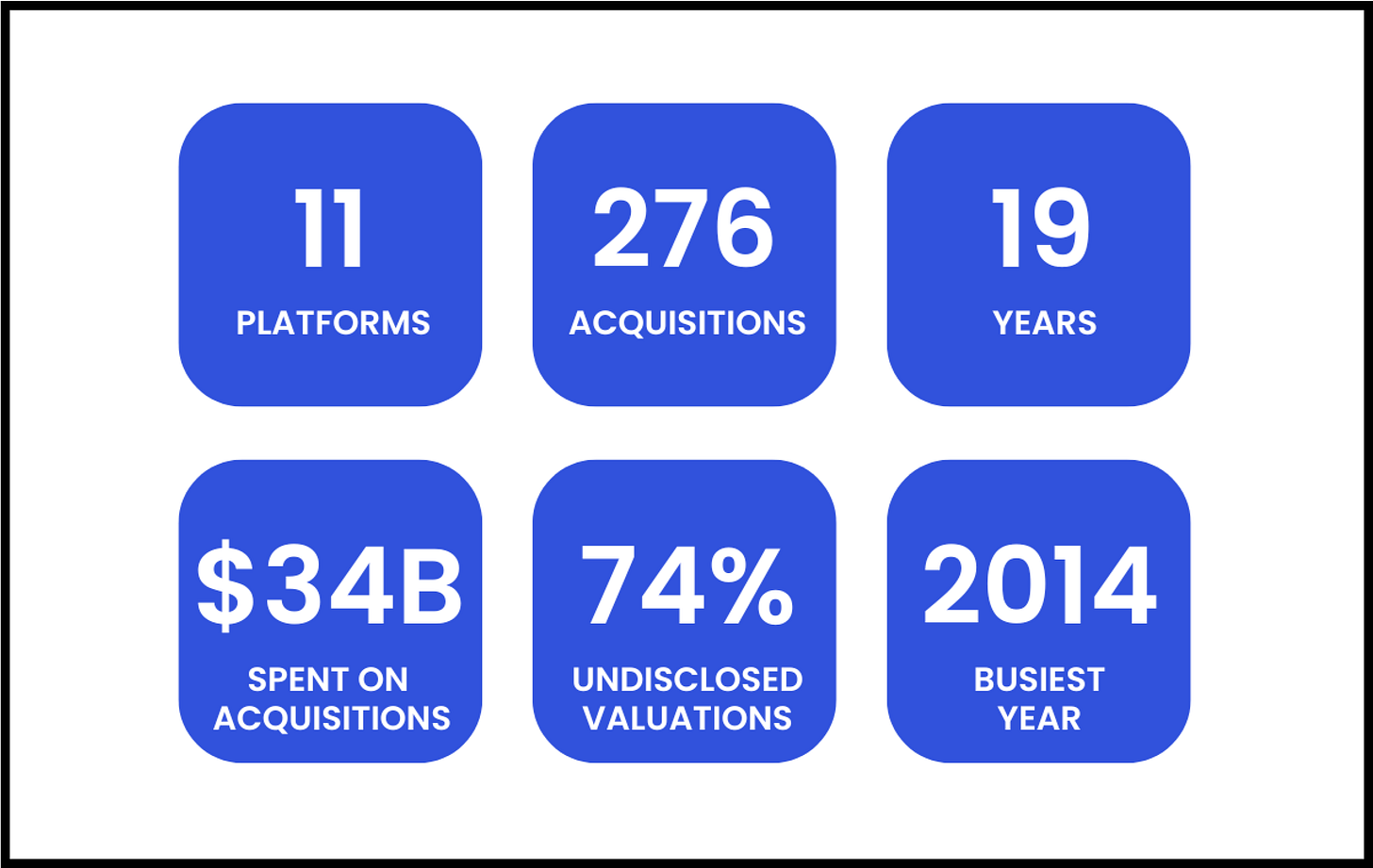

We compiled an exhaustive list of 276 acquisitions made by the 11 largest global social media platforms via press releases, SEC filings, and news coverage about public transactions.

Access all 270+ consumer social acquisitions

Included in this exclusive dataset you will find:

Buyer

Company

Description

Acquisition

Date & Price (M)

P.S. When you subscribe, you automatically get one year of free access to these AI tools, plus full access to our data room and all paywalled content.