Pitch Deck Red Flags

🚩 The common mistakes founders make when raising. When evaluating startups, spotting red flags early can save time, money, and reputation

Welcome to NEW ECONOMIES, rooted in my experiences working in venture capital. From inside the venture world, one thing is clear: we’re not just in a tech boom—we’re living through a full-blown economic rewrite. New platforms, new business models, and evolving public market strategies are reshaping everything.

Our work is primarily reader supported, with additional support from select sponsors. Stay on top of the latest technology trends and help sustain our work by subscribing—free or paid. Your money goes directly towards reporting costs.

When evaluating startups, spotting red flags early can save time, money, and reputation.

In this edition, we’re discovering the common pitfalls founders make when designing their pitch decks and the common red flags investors see.

From inflated market sizes and vague business models to solo founders without technical support and claims of “no competition,” these red flags can quickly turn investors off. We're here to help you avoid the most common—and costly—mistakes.

Let’s take a closer look at those red flags and how you can avoid them.

🤩 POOR STORYTELLING & DESIGN

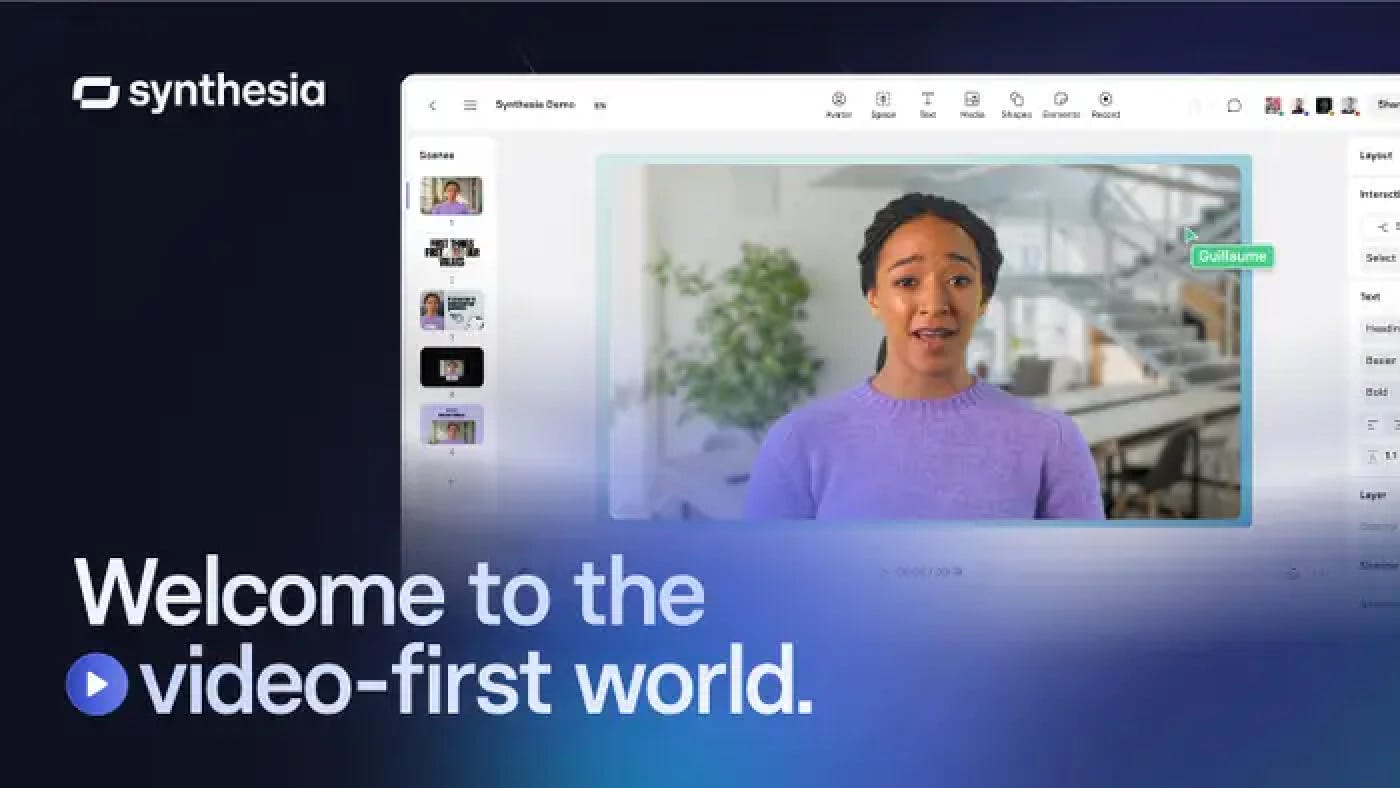

Remember, an investor will likely spend only a few minutes reviewing your pitch deck—if that. It's essential that your deck clearly and simply explains what your product or service does, without relying on jargon or insider language that only you understand. The deck should be consistent with your brand and website, and it should be concise.

Who does it well: Synthesia.

🔍 TEAM

Having a long list of advisors but only a small core team on your slide doesn’t make a strong impression.

Investors are primarily backing you—the founders—so your pitch should position you as the team capable of executing the vision. Advisors can add credibility, but you don’t need a whole football team of them. Focus on highlighting the core team’s strengths and why you're the ones to bet on.

Resources: Looking for experienced and well-respected operators to join your team as advisors? Upgrade your NEW ECONOMIES subscription to become a paid member of our exclusive community—where top operators connect and collaborate with startups like yours.

These are some of the top operators in the ecosystem—don’t miss the chance to bring one on board!

🌍 MARKET OPPORTUNITY

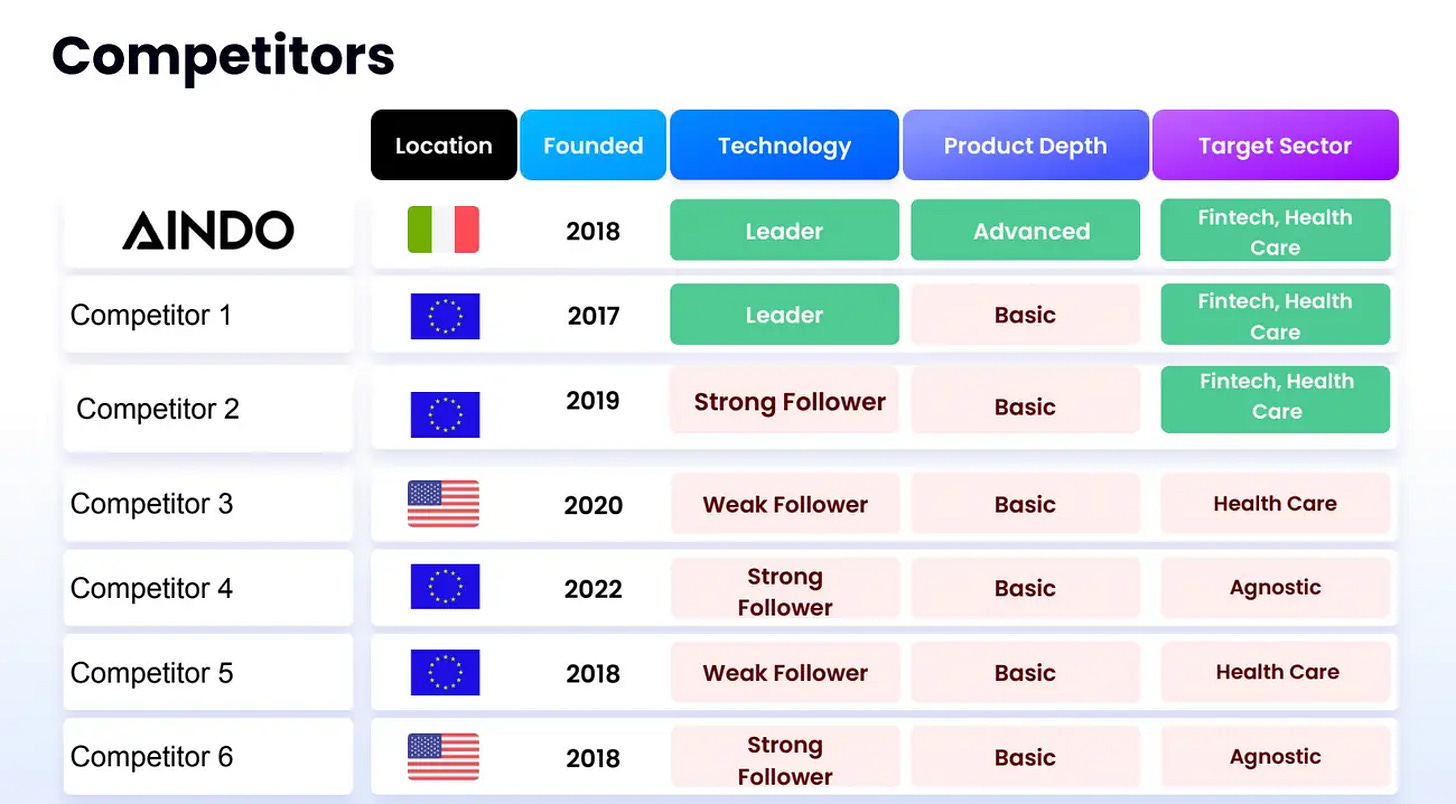

Claiming you're the only player in the market is usually a red flag. More often than not, it suggests there's little demand for the product—or that you haven’t done enough market research. Instead, show that you understand the competitive landscape and clearly define the opportunity.

Investors want to know two key things: How big is the market? And what kind of return on investment could this generate? A well-defined market with active players often signals real demand and greater potential for growth.

Remember, when investors back you, they’re typically aiming for at least a 10x return on their investment.

👀 COMPETITION

Don’t hide anything on your competition slide—investors can easily find your competitors themselves through startup databases.

If you’re in a crowded space, this is your chance to stand out. Clearly show how you plan to win the market, what makes your product meaningfully different, and why your team is the one best positioned to succeed. Transparency builds trust, and differentiation builds conviction.

Example: Aindo does a great job of this.

💰 FINANCES

Keep your forecasts focused on the next 12–18 months.

Let’s be realistic—predicting where your business will be in five years is nearly impossible, especially in the early stages. Investors aren’t expecting a crystal ball; they want a grounded, credible view of your near-term goals and how you plan to get there. Short-term forecasts are far more actionable and trustworthy.

❗️ FUNDRAISING AGENTS

Avoid hiring fundraising agents who take a commission just for making introductions to investors. If you're relying on that, it may be a sign you're not ready to lead a company.

Instead, focus on building direct relationships—especially with VC associates at the firms you're targeting. While they may be junior, they're often the first line of defense in the screening process and can become your biggest internal champions if you make a strong impression.

📈 TRACTION

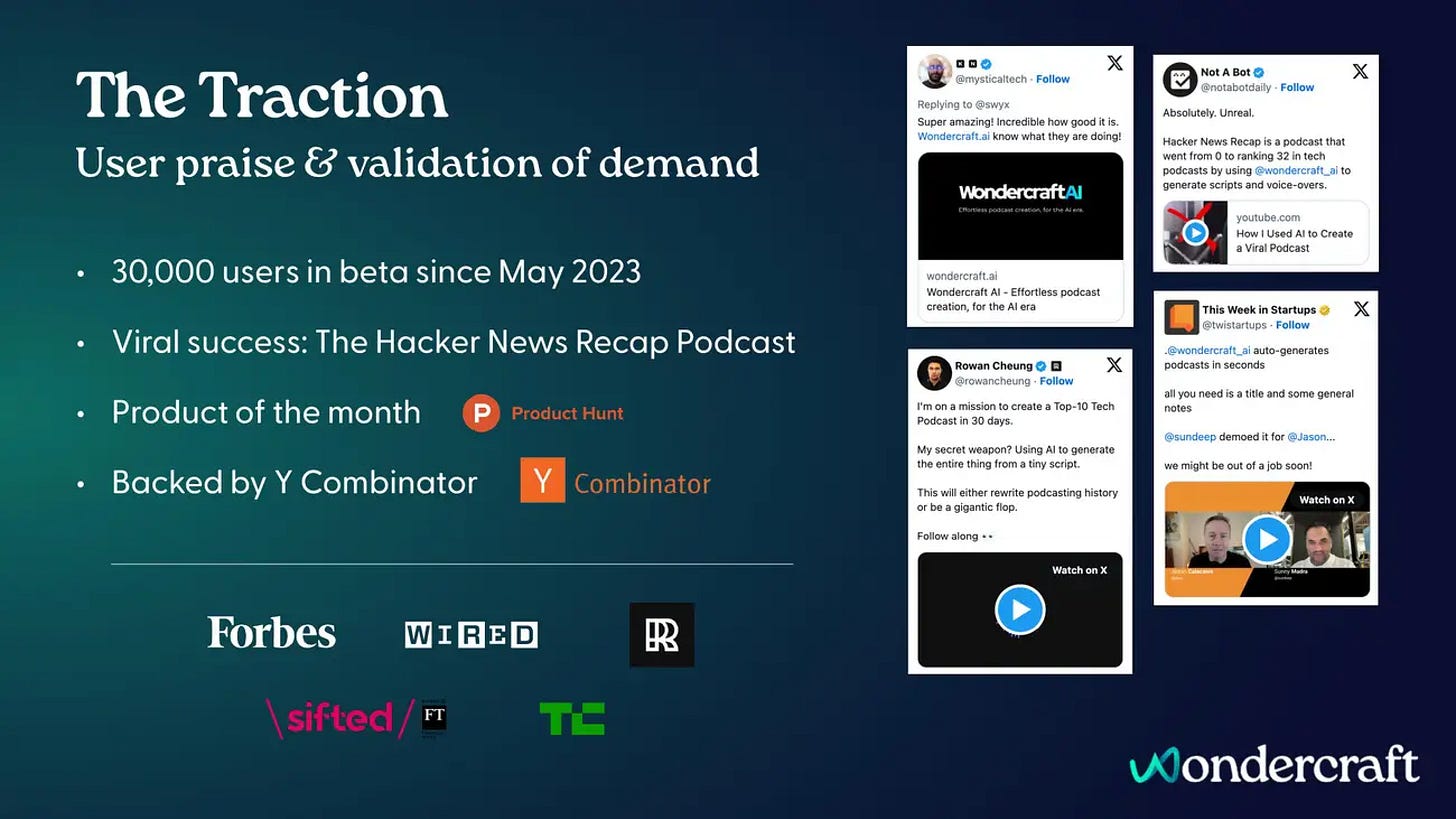

Are customers actually using your product?

Founders often miss a valuable opportunity to showcase real traction. Don’t make that mistake. Demonstrate how your product is gaining momentum by including clear, credible achievements such as:

Number of users acquired within a specific time frame.

Viral success: featured on Hacker News, X (Twitter), or LinkedIn.

Recognitions like “Product of the Day” or “Product of the Month” on Product Hunt.

Backing from Y Combinator or other well-respected accelerators or investors.

If possible, name some of your customers.

These signals help investors quickly understand your momentum—and why they should care.

Example: Wondercraft.

🔢 METRICS

Remember to include key metrics—but avoid oversharing. The goal is to showcase momentum and credibility without revealing sensitive data too early. A great example is Vercel’s pitch deck, which highlights positive trends and traction through growth indicators, without disclosing exact numbers. It strikes the right balance: enough to build interest, but not so much that you lose leverage.

🚀 VISION

Investors want to know how big you can take this. Don’t forget to include your vision!

Example: ElevenLabs pitch deck.

🤝 CONNECTING WITH INVESTORS

Do your research before reaching out, and double-check that your email and pitch deck are free of spelling or formatting mistakes.

If a firm doesn’t invest in your category—or has already backed a close competitor—you’re unlikely to hear back. To improve your chances, make sure the investor:

Invests in your category.

Invests in your geography.

Invests at your stage.

Has not invested in a direct competitor.

If you can find recent talks or presentations where investors mention interest in the category you’re building in, that’s a strong signal.

Finally, target the individual within the firm who is most aligned with your space—getting the right internal champion makes all the difference.

WE WANT TO SUPPORT YOU!

Want access to our global database of 5,000+ investors? Upgrade your NEW ECONOMIES subscription by becoming a paid subscriber. You’ll not only unlock invaluable resources that can save you hundreds of hours of research, but you can also gift a subscription to a fellow founder of your choice.

🔥 HOW TO CREATE A GREAT PITCH DECK

Become a paid subscriber today and receive personalized feedback on your pitch deck—including guidance on how to structure it effectively. Hundreds of founders have already taken advantage of this support!