Weekly Digest: Nvidia doubles down on its ‘second home’ Israel, Lightspeed raises record $9B in fresh capital, and OpenAI is reportedly trying to raise $100B at an $830B valuation.

December ecosystem highlights before the festive season — startups, venture trends, M&A moves, and must-watch interviews.

Another week, another roundup of recent tech news — let’s dive in. But first:

Meet this week’s partner: Framer

Framer is giving early-stage startups a full year of the Pro Plan — at no cost.

Why Framer?

Framer is the design-first web builder that helps startups launch fast. Join hundreds of YC founders already building on Framer.

What You Get:

1 year of Framer’s Pro Plan ($360 value)

Fast, professional site — no dev team needed

Scales with your startup — from MVP to full site

Who’s Eligible? Pre-seed and seed-stage startups. Offer available to new Framer users only.

Spots are limited — apply as soon as possible to access. It’s an easy win!

The startup ecosystem is evolving so much (and fast)

The startup ecosystem is shifting fast. The AI bubble is in full swing, $100M ARR is the new badge of honor over unicorn status, startups are raising record rounds, new VC funds are emerging, and acquisitions are heating up.

To help you make sense of it all, we’ve rounded up the most talked-about startup stories from the past few weeks — broken down into these categories:

🔔 NEW ECONOMIES: The Latest Trends

🗝️ Read of the week

🔍 Top tech news

💰 Startup funding news

👀 New VC funds

🤝 Acquisitions

🎤 Must-watch interviews

📊 Graphs of the week

Let’s dive in 🚀

🔔 NEW ECONOMIES: The Latest Trends

One mega-interesting trend is happening right now…

Young(ish) software companies are entering sports as brand partners.

Recently:

Deel → Premier League with Arsenal Football Club

Airwallex → F1 with McLaren Racing

Why this is worth watching:

Instant global brand recognition.

Borrowed trust from the world’s biggest teams.

A very public signal to competitors.

This is a land grab — once these partnerships are taken, latecomers are locked out.

Expect many more still-young software companies to enter sports in 2026.

🗝️ Read of the week

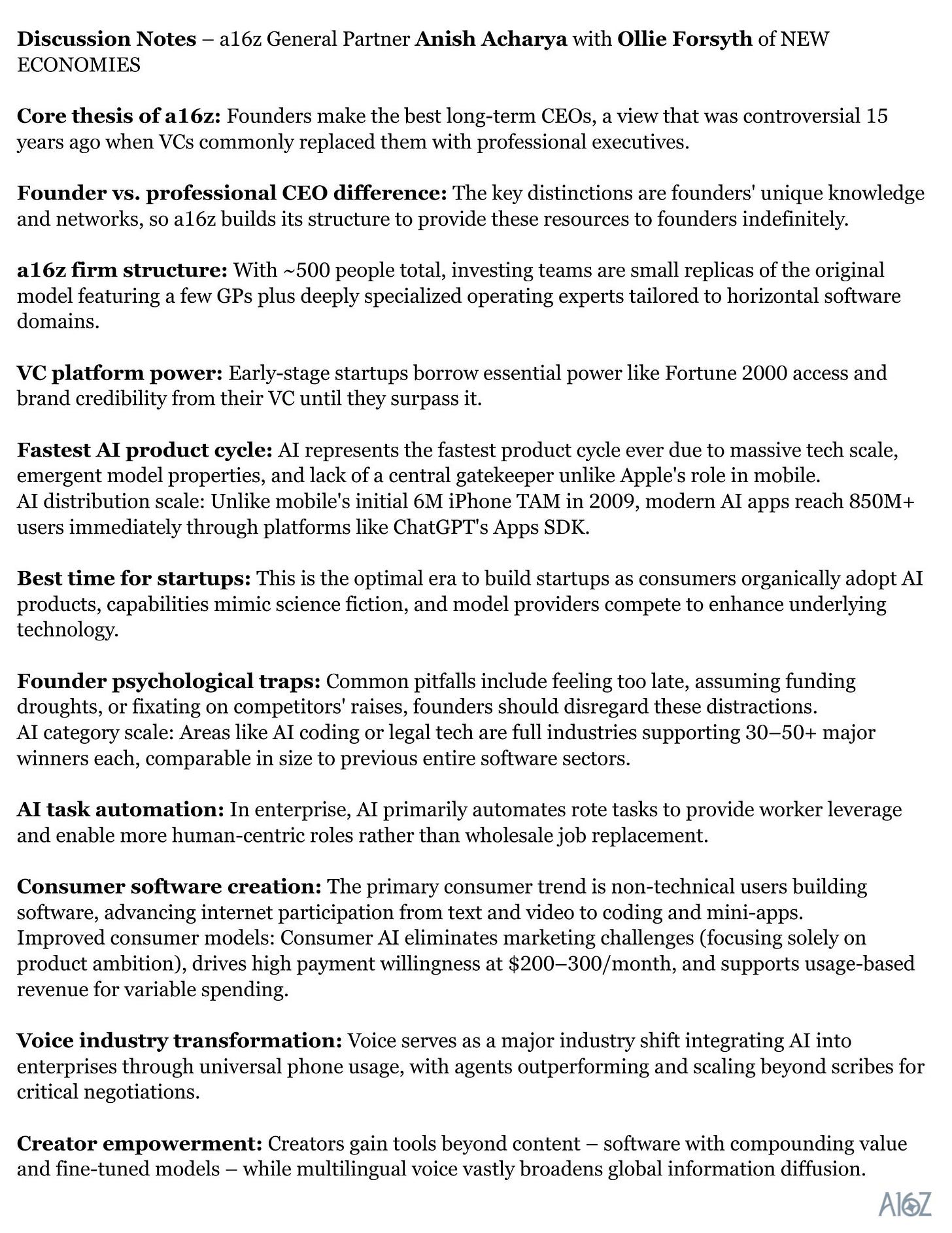

Notes on building in the AI era (plus how Andreessen Horowitz operates)

Great conversation with Anish Acharya on the current product cycle, founder psychology, and what AI-native networks unlock next.

A few takeaways 👇

1/ Consumer is hyper-cyclical and incredibly high-stakes — most of the Mag7 are consumer companies for a reason.

2/ The consumer window has blown wide open: new channels × new tech × new behavior.

3/ This is the best founder experience in years.

You spend time on product problems, not marketing problems.

4/ The world is profoundly short software.

That’s why AI code companies are working — and why there’s room for another dozen winners.

5/ The internet keeps expanding participation:

Text → video → software creation.

AI-native networks will create a new status game around building & using apps.

6/ Voice is the AI insertion point in the enterprise — and is often more human than humans.

7/ Think industries, not markets.

We consistently underestimate how big markets become.

8/ Creators are founders too.

They can now build software, media empires, and real digital businesses — not “just” content.

Watch the episode in full

🔍 Top tech news

The latest and most notable tech news from recent weeks:

OpenAI is reportedly trying to raise $100B at an $830B valuation.

Vibe-coding startup Lovable raised $330M at a $6.6B valuation. The round was led by CapitalG and Menlo Ventures — Khosla Ventures, Salesforce Ventures and Databricks Ventures also participated, as did other investors. This raise comes mere months after Lovable raised a $200 million Series A round that valued the company at $1.8 billion in July.

Meta’s former Chief AI Officer, Yann LeCun targets €3bn valuation for his AI startup Turing and in talks to raise $586M ahead of January launch.

Monzo shareholders push to oust chair in revolt over CEO’s exit.

OpenAI hires George Osborne to spearhead global ‘Stargate’ expansion.

Nick Clegg takes on venture capital role — Former UK deputy prime minister joins London-based Hiro Capital.

The Oscars will begin streaming on YouTube starting in 2029 and will continue through at least 2033.

Trade Republic has become Germany’s most valuable start-up after investors including Peter Thiel’s Founders Fund agreed to back the fintech at a €12.5bn valuation.

TikTok has agreed to transfer significant control of its U.S. business to a group of American investors, ending a long dispute with the U.S. government over national security concerns. The new joint venture will be owned mainly by Oracle, Silver Lake, and MGX, with ByteDance keeping a smaller stake. The U.S.-based entity will oversee data security, algorithms, and content moderation, with the deal expected to close in January 2026.

OpenAI is adding interactive third-party apps directly into ChatGPT, letting users chat with services like Spotify, Figma, Coursera, and Zillow.

Nvidia doubles down on its ‘second home,’ Israel.

💰 Startup funding news

The latest and most interesting startups that have raised funding and should be on your radar:

Fuse Energy raised $70m backed by Balderton and Lowercarbon Capital.

Khosla co-leads $86m Series D in UK AI voice agent PolyAI.

Peec AI reaches $5M ARR — less than 12 months after being founded.

Ankar AI raised $20M Series A led by Andreas Helbig at Atomico, with Index Ventures doubling down and support from Norrsken VC, daphni, BOOOM, Motier Ventures and Puzzle Ventures.

Kontigo (YC S24) just raised a $20M Seed round to build the largest bank in the world. The startup just crossed $30M in annual revenue, $1B in payment volume, and 1M users in under 12 months, with a team of six engineers and one designer.

Leona Health raised $14 million in seed funding led by Andreessen Horowitz, with participation from General Catalyst; Accel; Maven. Its founder, Caroline Merin, spent nearly a decade developing on-demand services as the first Latin American general manager for Uber Eats and later the COO of Rappi.

Known uses voice AI to help you go on more in-person dates raised $9.5M.

👀 New VC funds

VC funds are continuing to raise. These are the latest:

Krafton, the South Korean gaming company behind hit titles such as PUBG and Battlegrounds Mobile India (BGMI), is launching a $670M growth investment fund focused on India, stepping up its push into the world’s largest internet user base.

Cloudberry raises €30m for semiconductor fund.

Lightspeed raises record $9B in fresh capital.

S3 Ventures announces $250m Fund VIII.

Israel’s Viola Ventures picks up $250M.

MBX Capital’s fund for early-stage startups raised $100 million.

FemHealth Ventures collects $65m for oversubscribed Fund II.

Monzo Bank founder Paul Rippon just launched a multi-million pound fund backing British Series A startups.

The Nordic Web Ventures, has raised $6 million for their third fund.

🤝 Acquisitions

The latest acquisitions that have taken place which should be on your radar:

AI coding assistant Cursor announced that it has acquired Graphite, a startup that uses AI to review and debug code.

M7 confirms €350m UK and French logistics portfolio acquisition.

Anonymous messaging app NGL was acquired by ‘EarnPhone’ startup Mode Mobile.

Findem acquires the ‘missing piece’ Getro to launch AI-powered job posts.

Coursera and Udemy enter a merger agreement valued at around $2.5B.

🎤 Must-watch interviews

The latest must-watch interviews from our podcast show:

Watch our recent podcast episodes:

Forget AI: Inside the Meltdown That Made Airalo #1 eSIM Unicorn | Ahmet Bahadir Ozdemir

The Hidden Skill Behind Every Successful Founder | Lindsay Kaplan.

The Harsh Truth About Building a Startup in the AI Era | Anish Acharya.

The AI Version of You Will Outperform You — Emad Mostaque.

How Solana Survived When Most Other Coins Fell | Anatoly Yakovenko.

This Is How AI Will Reshape Startups Forever | Henry Ward, Co-Founder of Carta.

Spotify’s Early Investor Shares His Blueprint for Outlier Founders | PJ Pärson (Northzone).

Watch now!

📊 Graphs of the week

The most interesting graphs we came across this week:

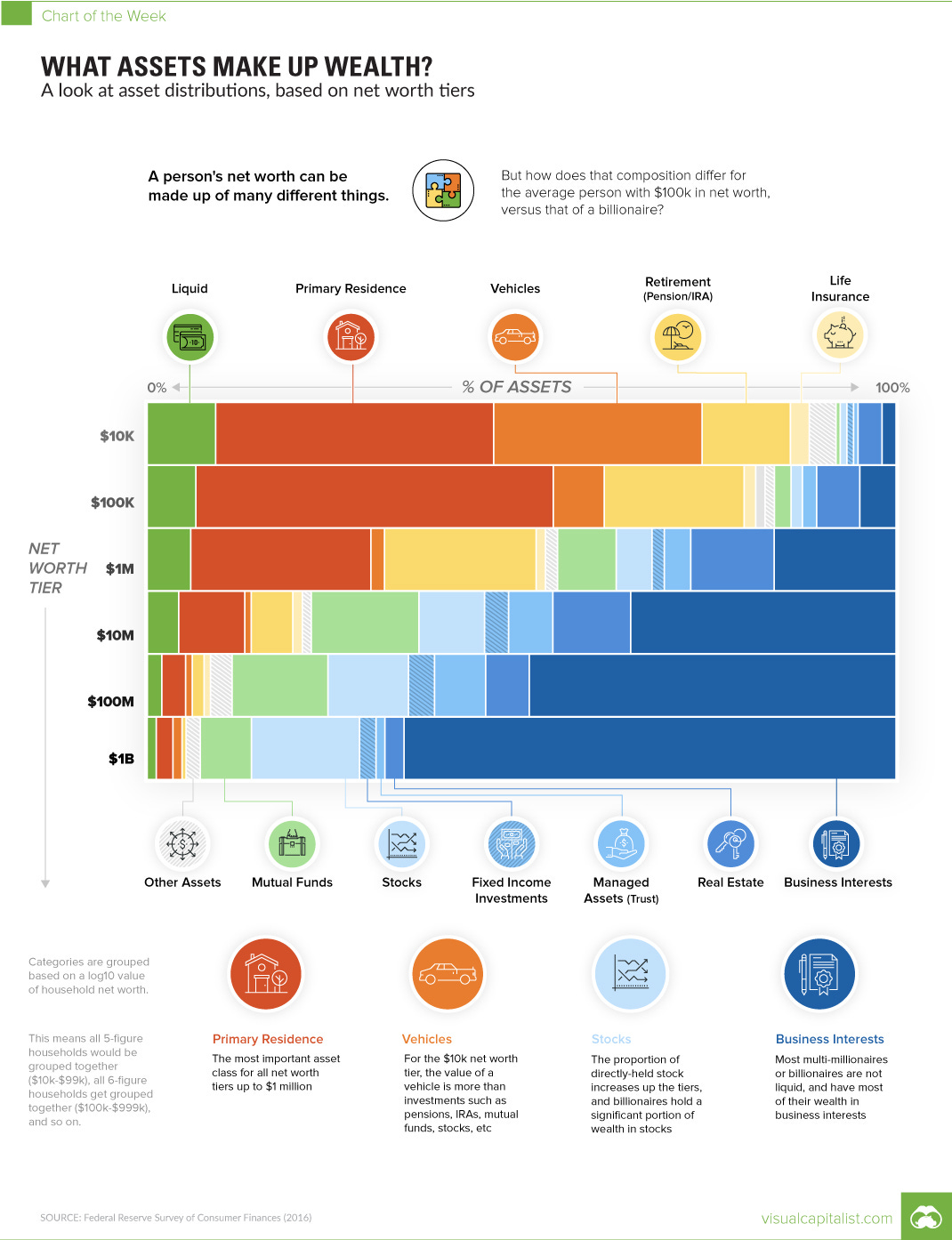

What assets make up wealth? A look at asset distributions based on net worth tiers.

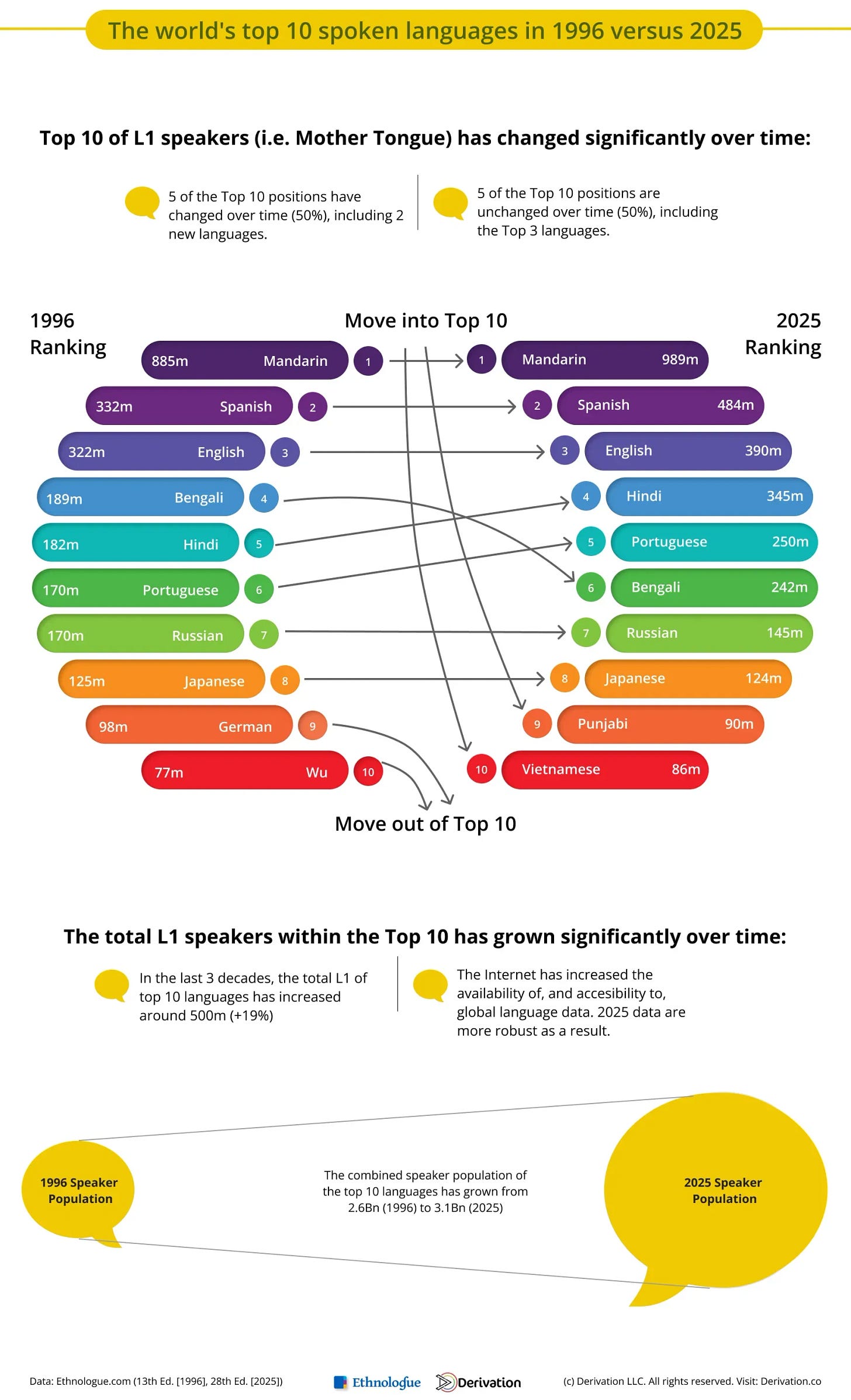

The world’s top 10 spoken languages in 1996 versus 2025

If you enjoyed this edition, help sustain our work by clicking ❤️ and 🔄 at the top of this post.

FYI, these are not the top 10 spoken languages.

300 million people speak French around the world.

The stat here is about "official mother tongue". A good indicator of the population growth (or decline) of particular countries, but it's not the same thing at all.