2026 Creator Economy M&A Report

The ultimate analyses of all 81 acquisitions from the past year, highlighting the key trends shaping the future of the creator economy

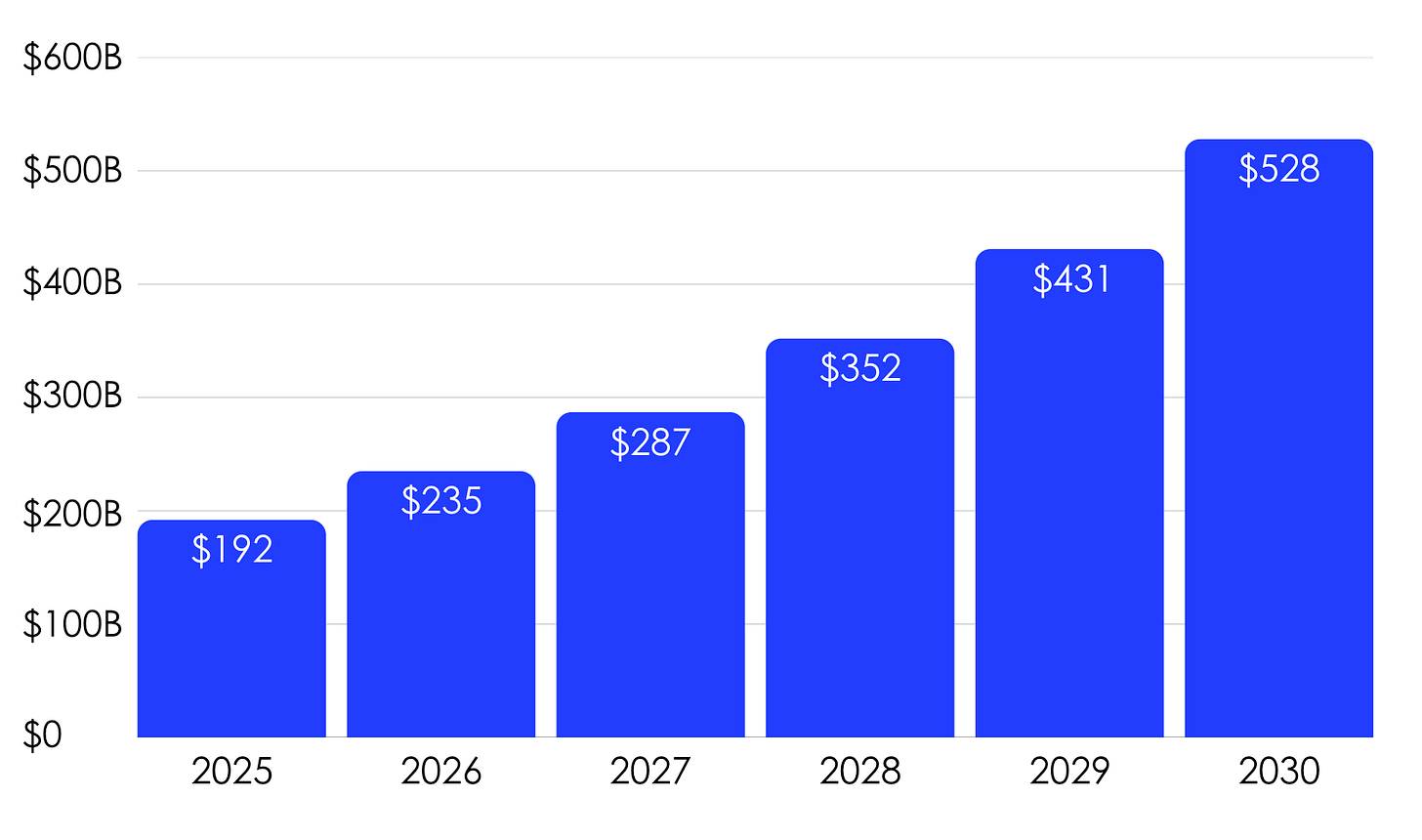

The creator economy is a $235B global market growing at a 22.5% CAGR. We recently collaborated with Quartermast Advisors, who just published a comprehensive analysis of 2025 M&A transactions across the creator economy — insights we will be sharing in this edition.

*Disclaimer: NEW ECONOMIES is a sponsor of this report.

About Quartermast Advisors

Quartermast Advisors are a boutique M&A advisory firm who produce regular reports on M&A activity within the creator economy. They provide guidance to startups and established global companies in digital media, technology, and the creator economy.

Throughout this edition, you will discover:

Transaction Volume: 81 M&A deals completed in 2025 (17.4% YoY increase).

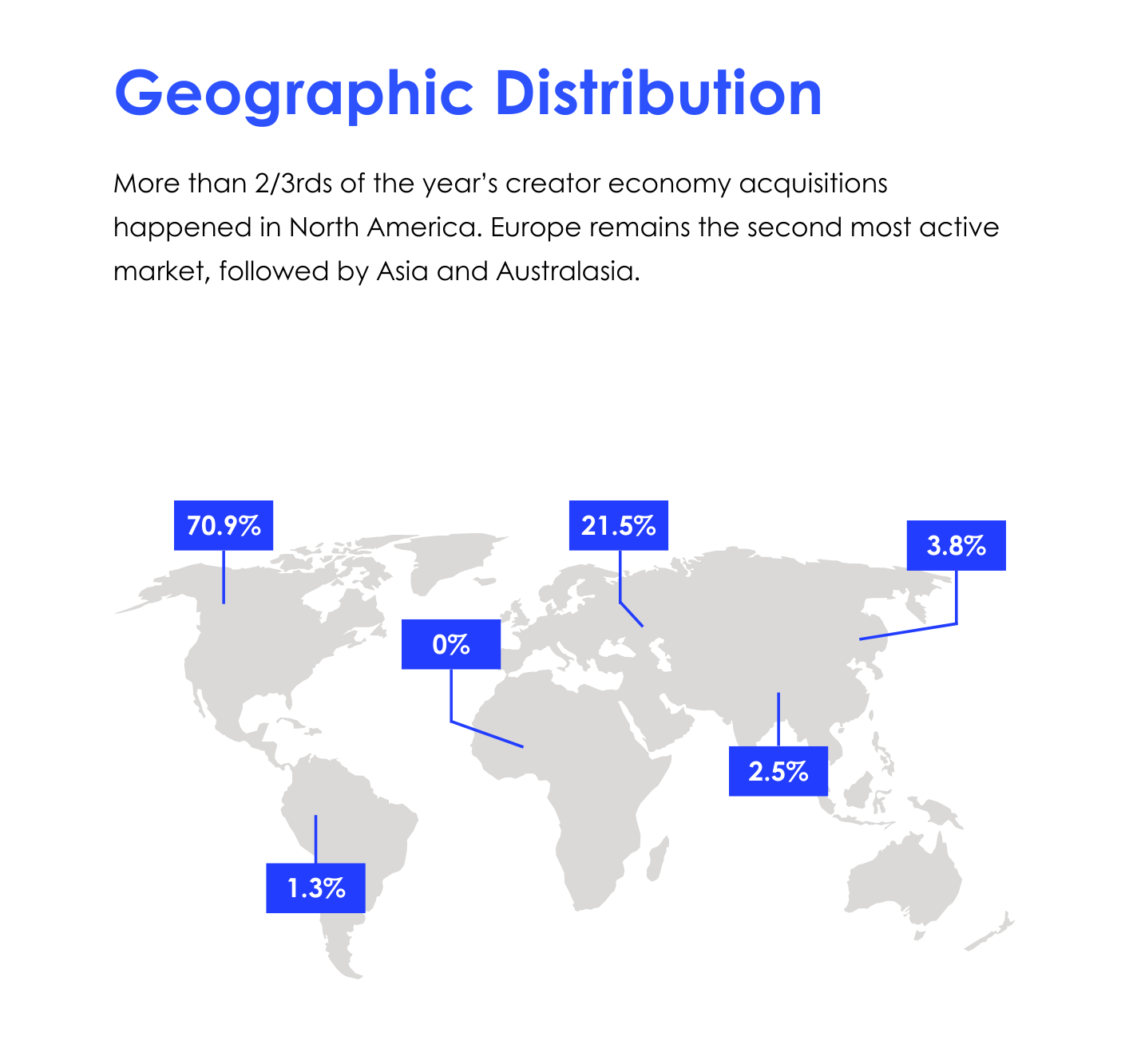

Market Leadership: North America dominates with 71% of transactions.

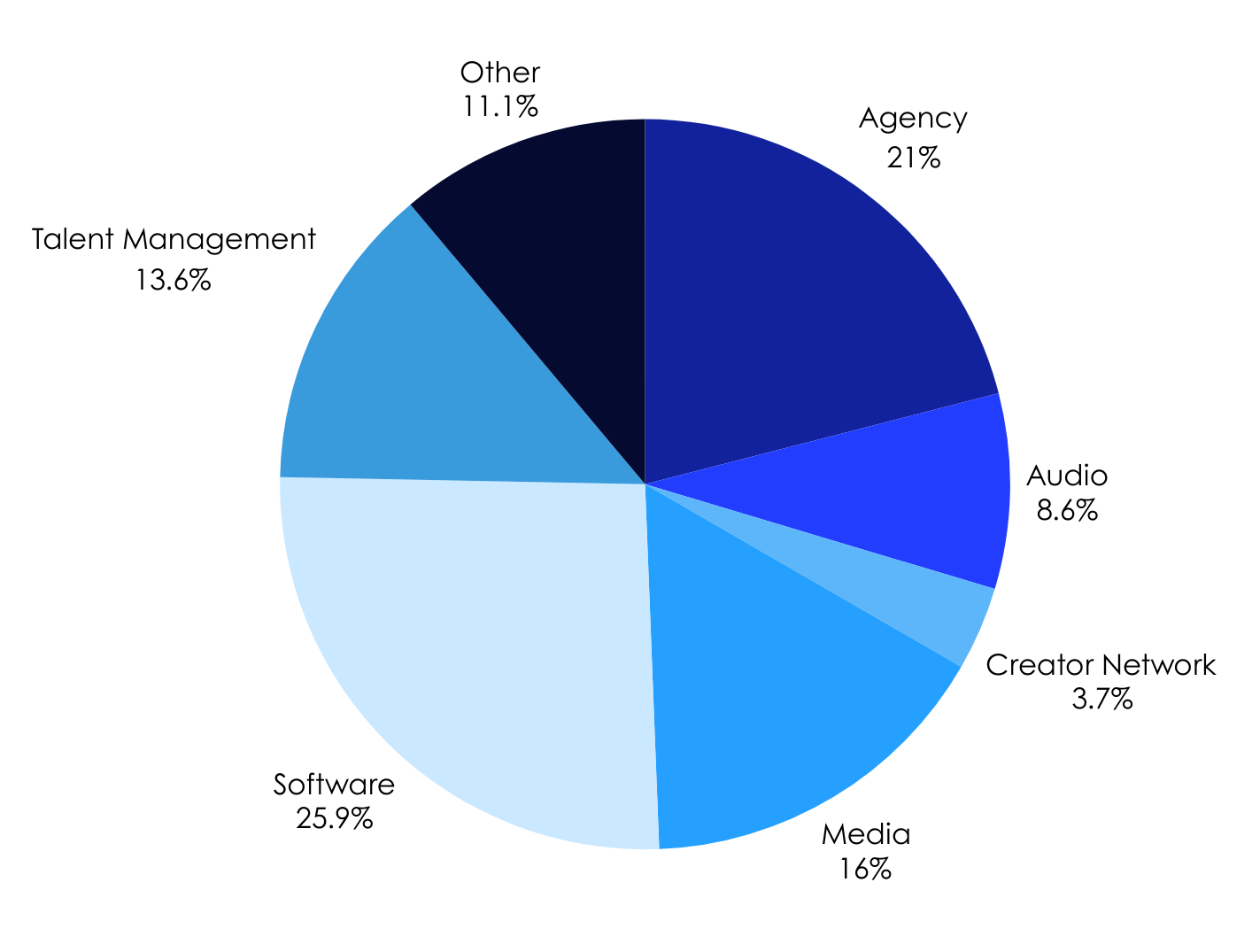

Sector Focus: Primary acquisition targets include software (26%), agencies (21%), media properties (16%), and talent management firms (14%).

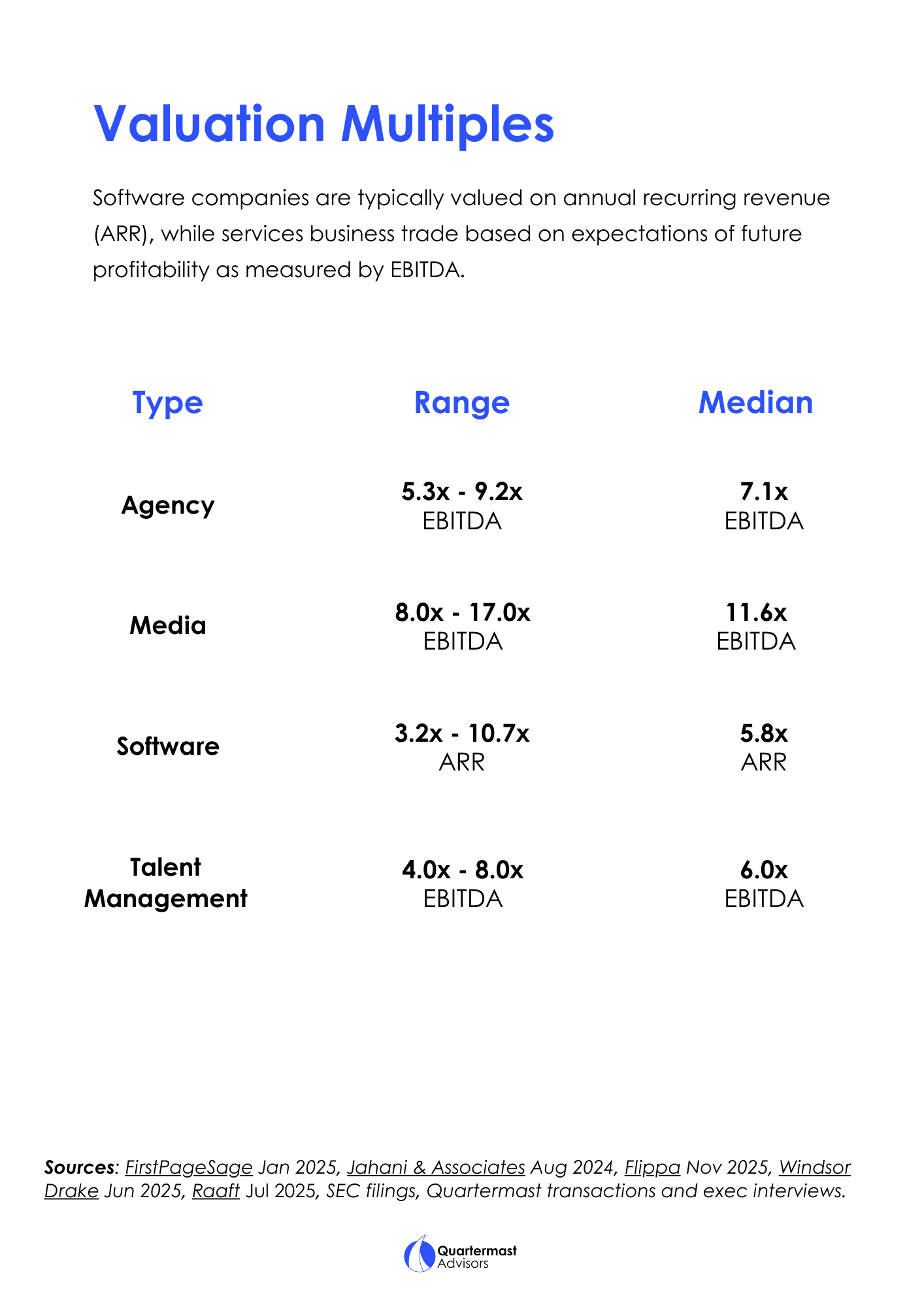

Valuation Range: Most creator economy companies are valued at 5x - 9x EBITDA.

Key trends: Shaping the future of the creator economy.

P.S. If you are interested in the wider creator economy, read our previous reports here.

Let’s dive in!

M&A Activity Analysis

Record year for creator economy M&A

Deal volume increased 17.4% YoY, from 69 transactions in 2024 to 81 transactions in 2025. Buyer demand surged as strategics and PE firms looked to enhance their capabilities, achieve greater scale, and strengthen their creator relationships. The result was an incredibly active market, which we expect to continue into 2026.

Larger transaction sizes

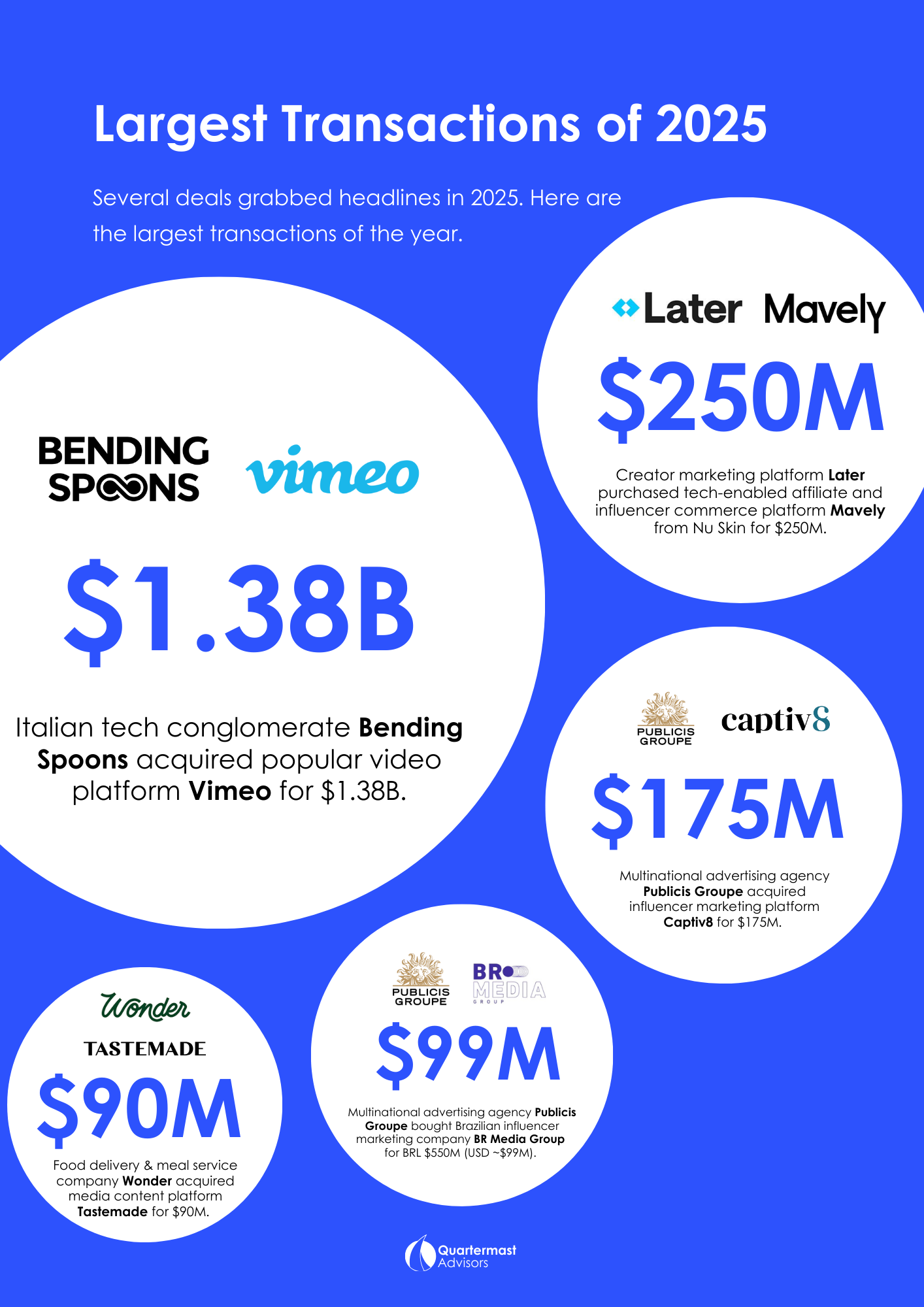

Average transaction sizes increased meaningfully, signaling growing confidence in the category’s potential and durability. Landmark deals like Bending Spoons x Vimeo, Later x Mavely, and Publicis x Captiv8 set strong benchmarks for valuation and strategic ambition.

Stable demand across key segments

Despite rising deal volumes, the category mix remained remarkably consistent YoY. Agencies, media companies, software platforms, and talent management firms all held roughly the same share of total activity from 2024 to 2025, suggesting broad-based conviction rather than a single trend-driven surge.

Decline in cross-border transactions

Cross-border M&A activity declined from 36.2% in 2024 to 27.2% in 2025. Buyers showed a stronger preference for domestic or regionally adjacent assets, perhaps due to regulatory complexity, integration risk, and macro uncertainty. Scale is still the goal, but proximity matters a bit more now.

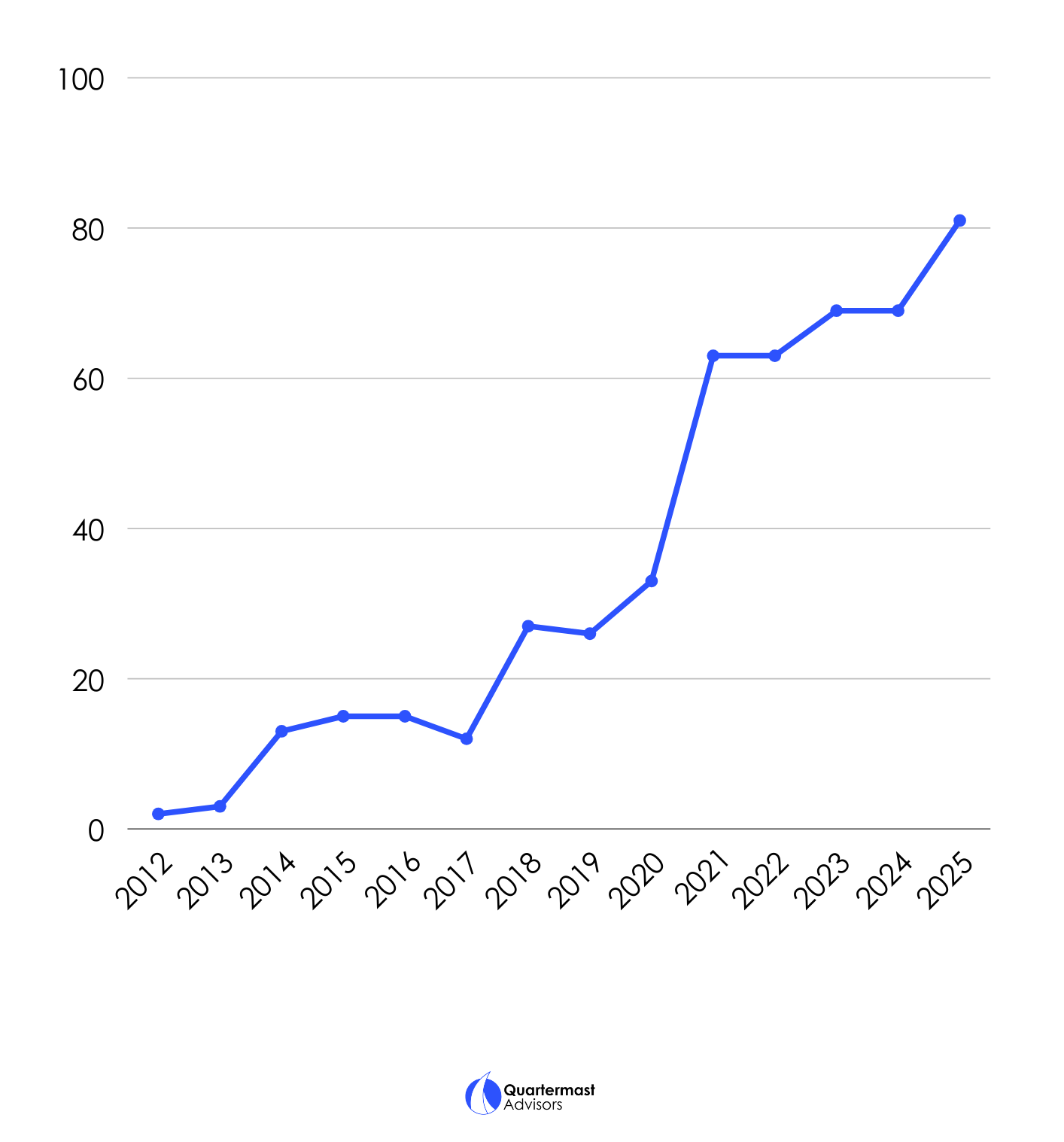

Annual Deal Volume

2025 was a record year for creator economy M&A, with a 17.4% increase in transaction volume YoY.

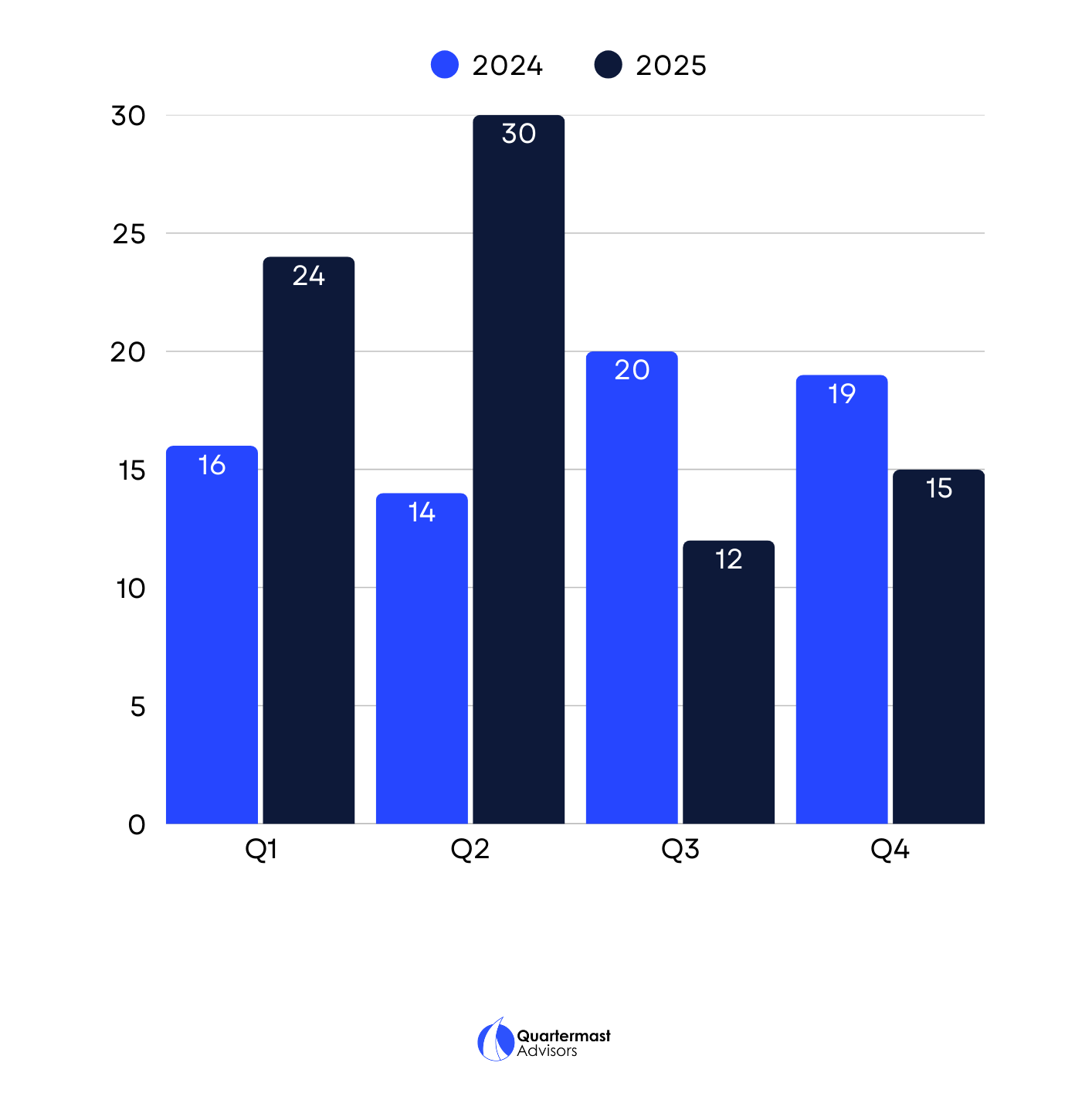

Quarterly Deal Volume

M&A activity surged in the first half of the year. While dealmaking appears to have moderated in the second half, reported volumes may understate actual activity, as some transactions completed in Q3 and Q4 may not have been publicly disclosed yet.

Largest Transactions of 2025

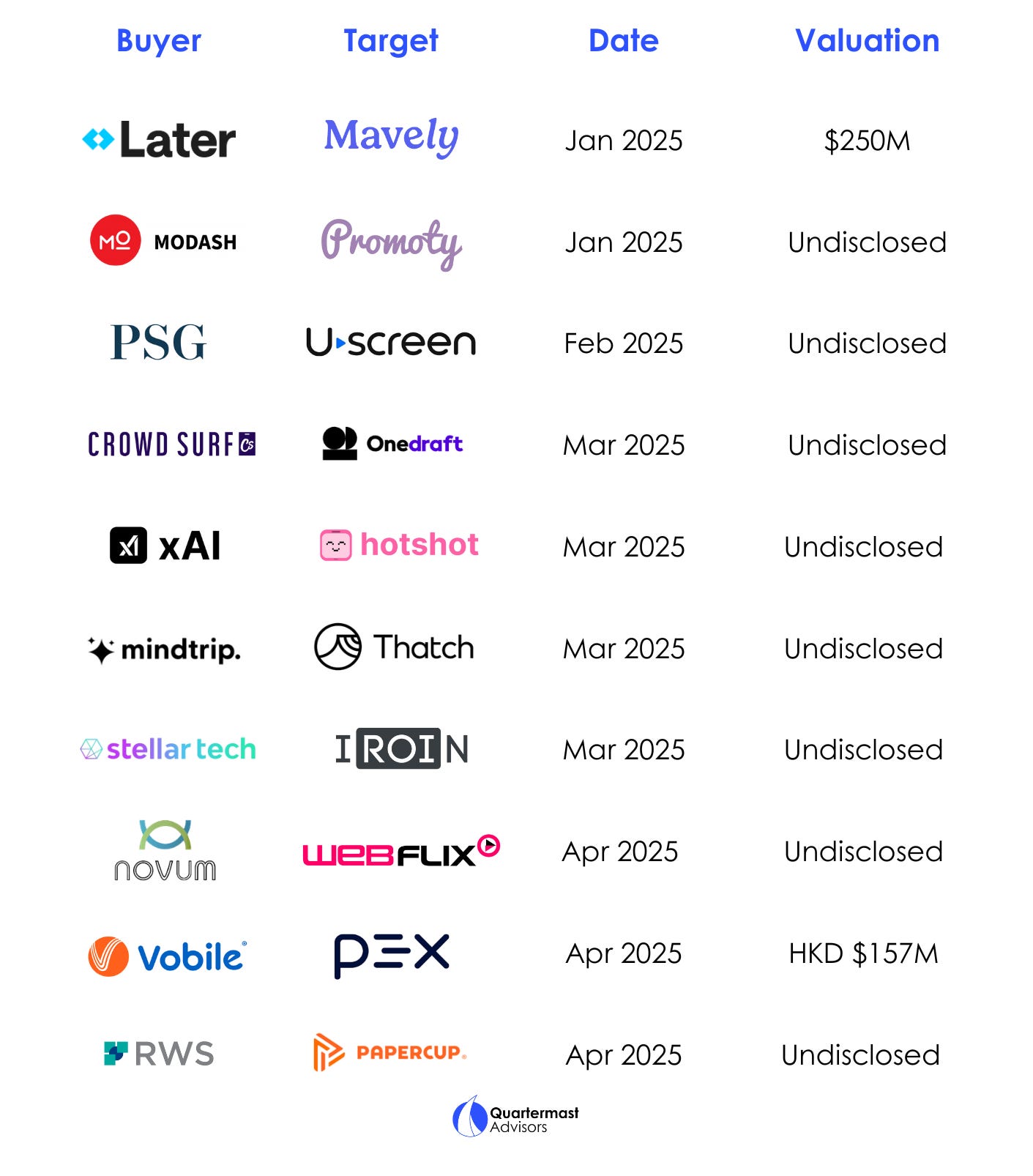

Several deals grabbed headlines in 2025. Here are the largest transactions of the year.

Target Profiles

Software businesses were most in demand, followed by agencies, media properties, and talent management firms.

Geographic Distribution

More than 2/3rds of the year’s creator economy acquisitions happened in North America. Europe remains the second most active market, followed by Asia and Australasia.

Valuation Multiples

Software companies are typically valued on annual recurring revenue (ARR), while services businesses trade based on expectations of future profitability as measured by EBITDA.

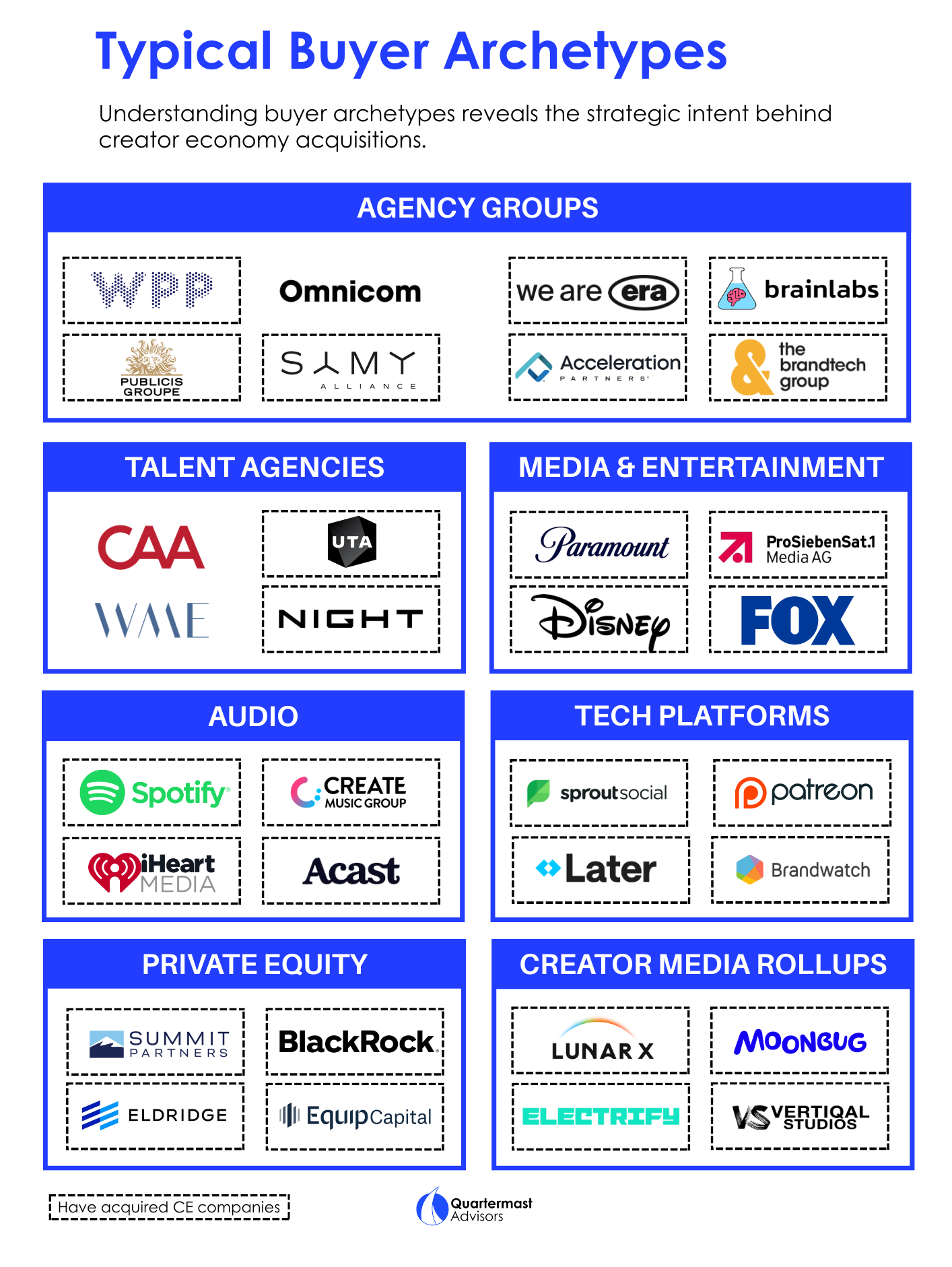

Buyer Profiles: Typical Buyer Archetypes

Understanding buyer archetypes reveals the strategic intent behind creator economy acquisitions.

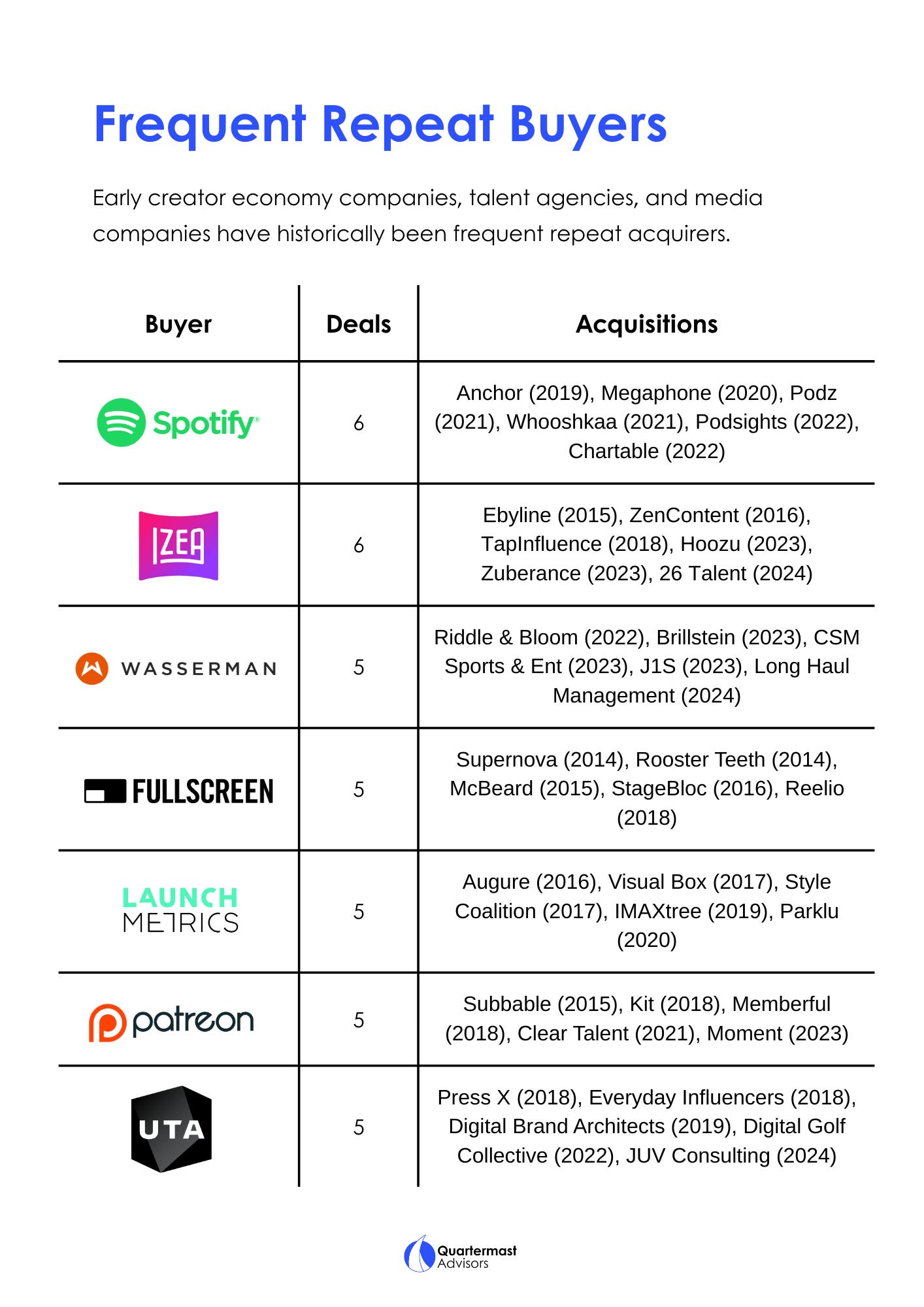

Frequent Repeat Buyers

Early creator economy companies, talent agencies, and media companies have historically been frequent repeat acquirers.

Transaction Summaries

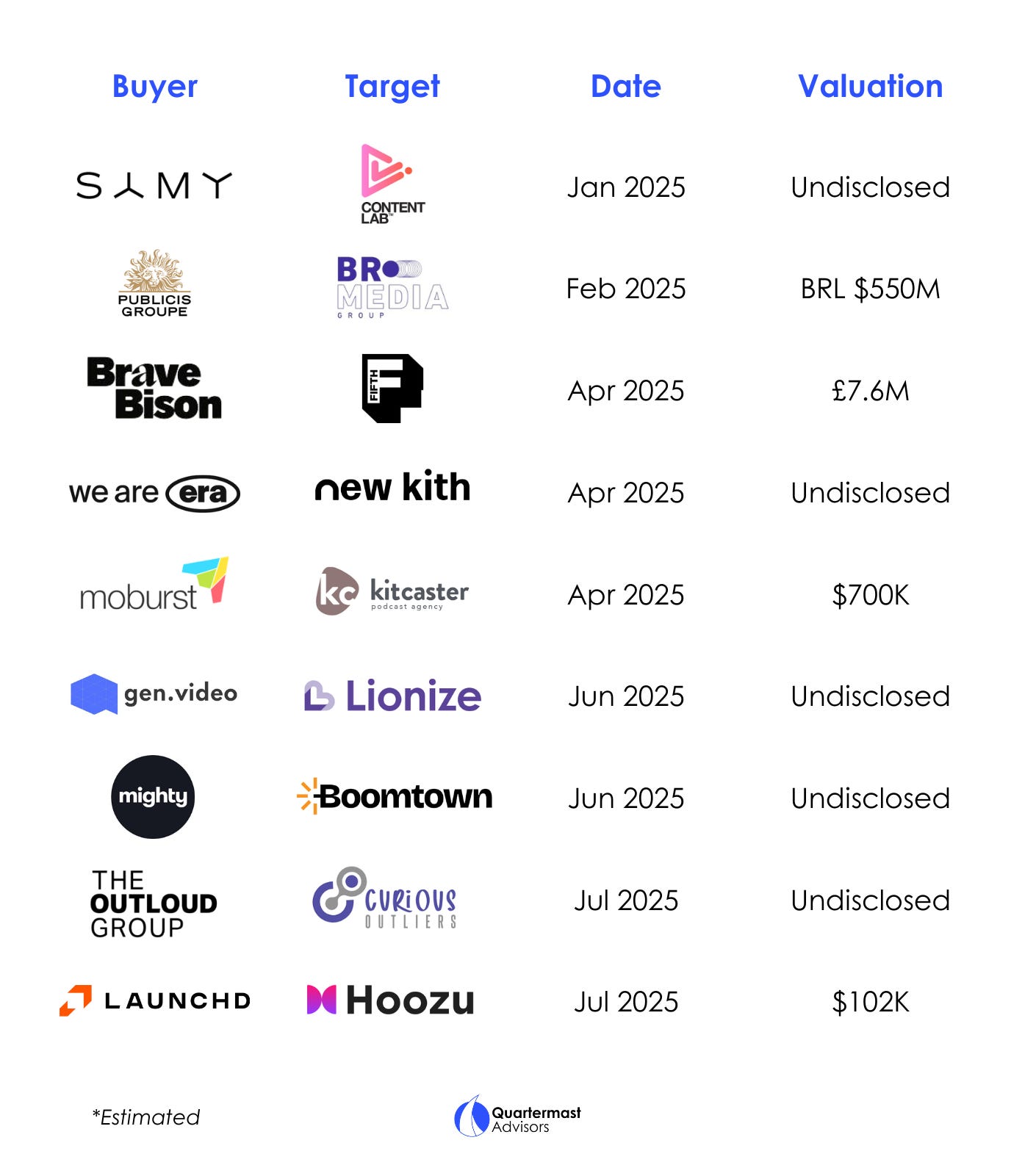

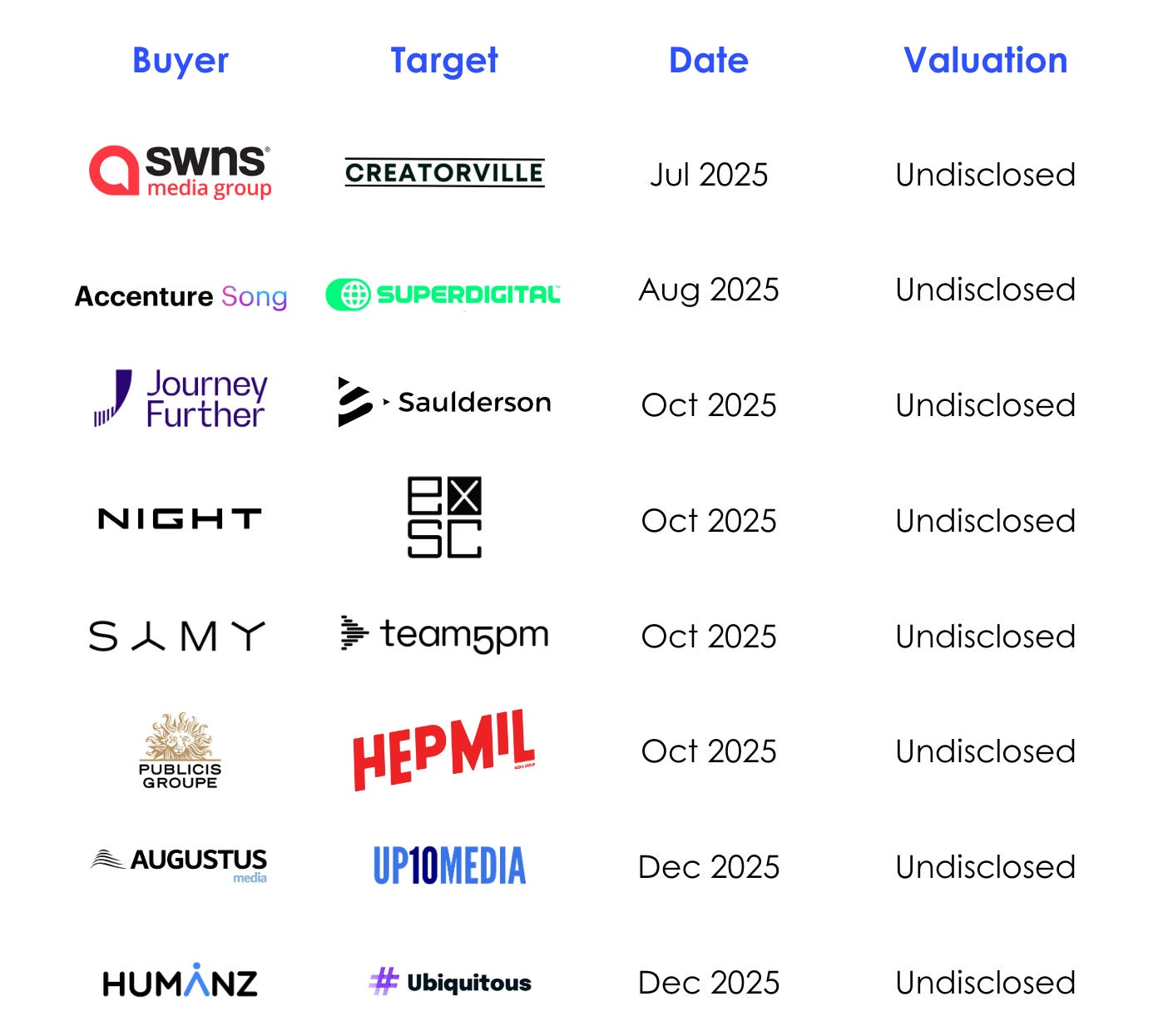

Agencies remain in strong demand, particularly those focused on influencer marketing.

Agencies (con’d)

Agencies remain in strong demand, particularly those focused on influencer marketing.

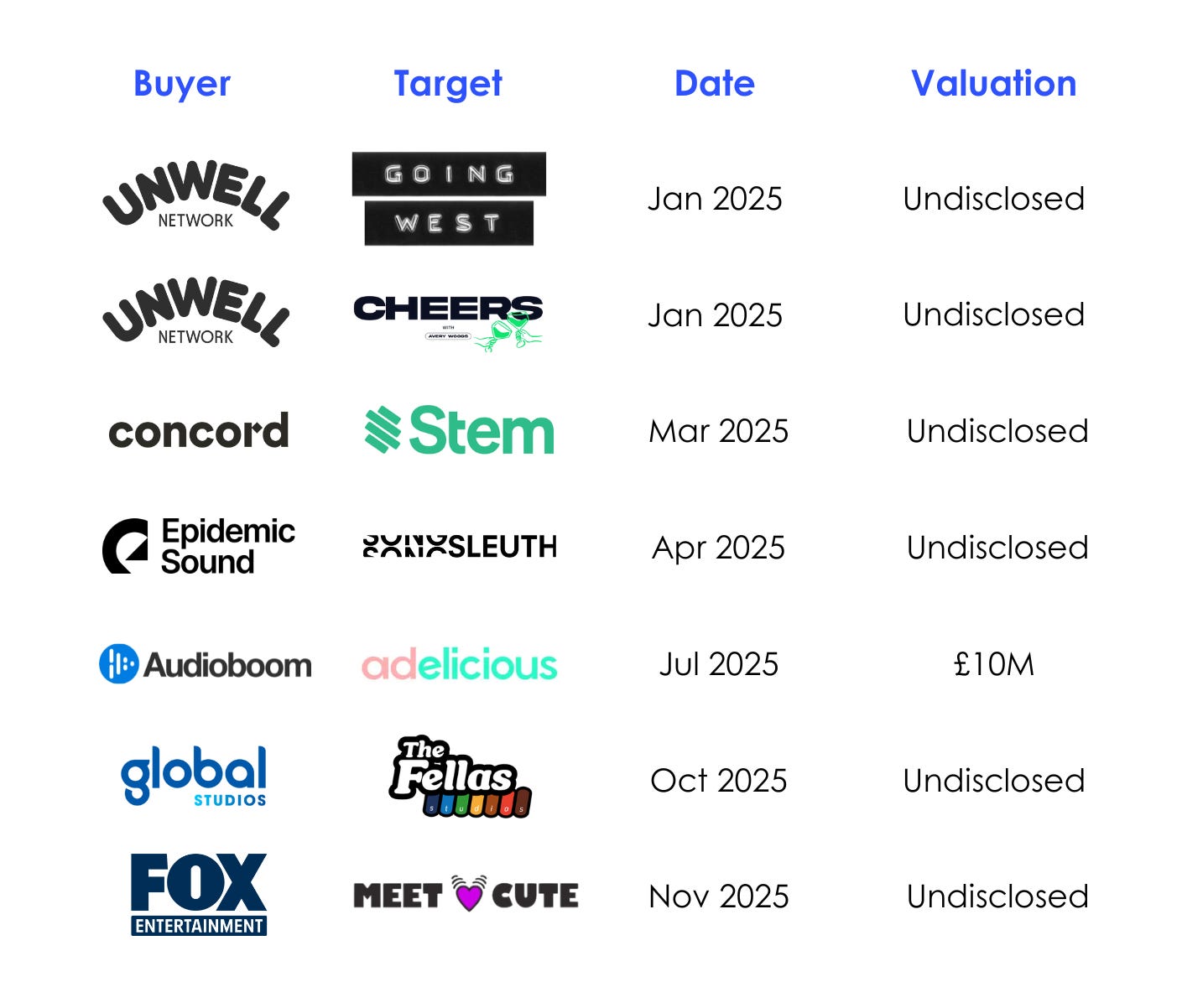

Audio

Podcasting and music M&A activity increased this year as buyers pursued scale, proven IP, and direct access to engaged audiences.

Creator Services & Networks

Creator services remains a relatively underserved market segment, though interest and activity is picking up. We expect to see more such transactions in the next 12 - 18 months.

Media

Buyers remain interested in media properties, including digital publishers, short-form video studios, and creator media companies.

Media (cont’d)

Software

Software is the most active category for creator economy M&A, spanning content creation, distribution, and monetization tools.

Software (cont’d)

Talent Management

Market consolidation continues among talent representation businesses. M&A activity for this sector was fairly consistent YoY.

Looking Ahead: 2026 M&A Predictions

Deal volume stays hot

After a record-setting 2025, creator economy M&A will be just as busy (if not more so) in 2026. Demand for creator economy businesses continues to increase as the category grows and more companies mature into compelling acquisition targets.

Creators ring the bell

More creator-founded companies will achieve meaningful exits this year. From media brands to consumer products, software, and more, buyers value creators’ built-in audience, cultural relevance, and native understanding of the space.

More picks-and-shovels acquisitions

Infrastructure businesses will become prized acquisition targets as the creator economy scales. Payments, analytics, fulfillment, and monetization tools form essential industry infrastructure, with defensible margins and diversified creator exposure.

Non-endemic buyers move in

Media, entertainment, and advertising incumbents will remain the most active acquirers, but a new wave of buyers is entering the category. Deals like Wonder x Tastemade and Sown Again x IPHIS signal a strategic shift. Food, retail, and CPG companies increasingly view creators as distribution, not just marketing.

If you enjoyed reading this edition, help sustain our work by clicking ❤️ and 🔄 at the top of this post.

Thanks for putting this together. I had no idea the creator economy has so much projected room to run. I guess I’m in the right place!