2025 H1: Creator Economy M&A Report

Exploring the latest M&A activity across the creator economy.

Welcome to NEW ECONOMIES, your go-to newsletter on the latest technology trends that are transforming our world.

Our work is primarily reader supported, with additional support from select sponsors. Stay on top of the latest trends and help sustain our work by subscribing—free or paid. Your money goes directly towards reporting costs.

THIS EDITION’S COLLABORATION

Quartermast Advisors is a boutique M&A advisory firm who produce regular reports on M&A activity within the creator economy. They provide guidance to startups and established global companies in digital media, technology, and the creator economy.

Throughout this edition, you will discover:

The M&A activity for the first half of this year across the creator economy.

Key trends happening right now.

The types of companies being acquired.

Who is buying these platforms.

P.S. If you are interested in the wider creator economy, read our previous reports here.

Let’s dive in!

CREATOR ECONOMY M&A LANDSCAPE 2025

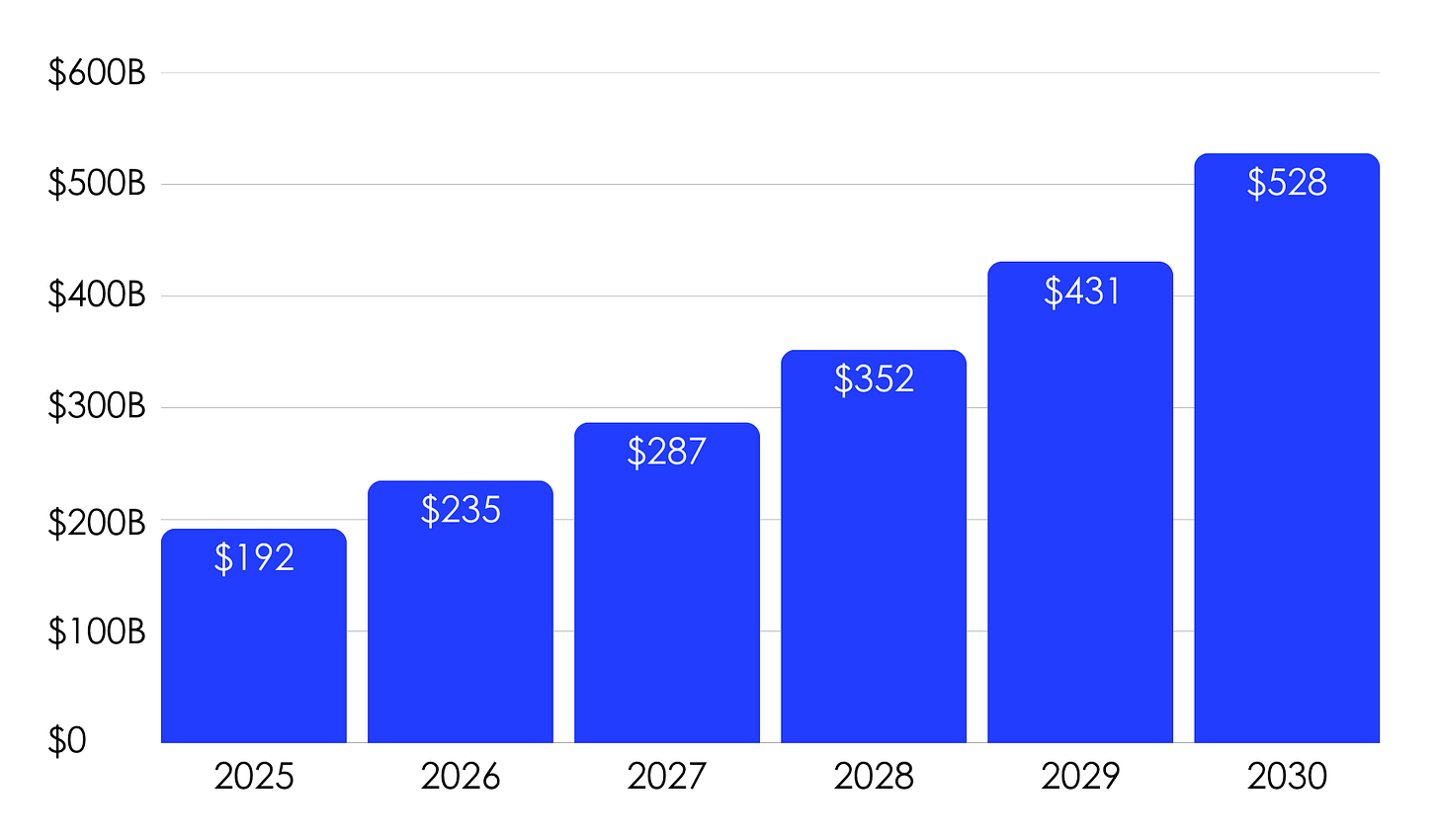

The Creator Economy is a $192B global market growing at a 22.5% CAGR. Our comprehensive analysis reveals a nuanced M&A landscape characterized by strategic consolidation, technological innovation, and global expansion.

KEY TAKEAWAYS

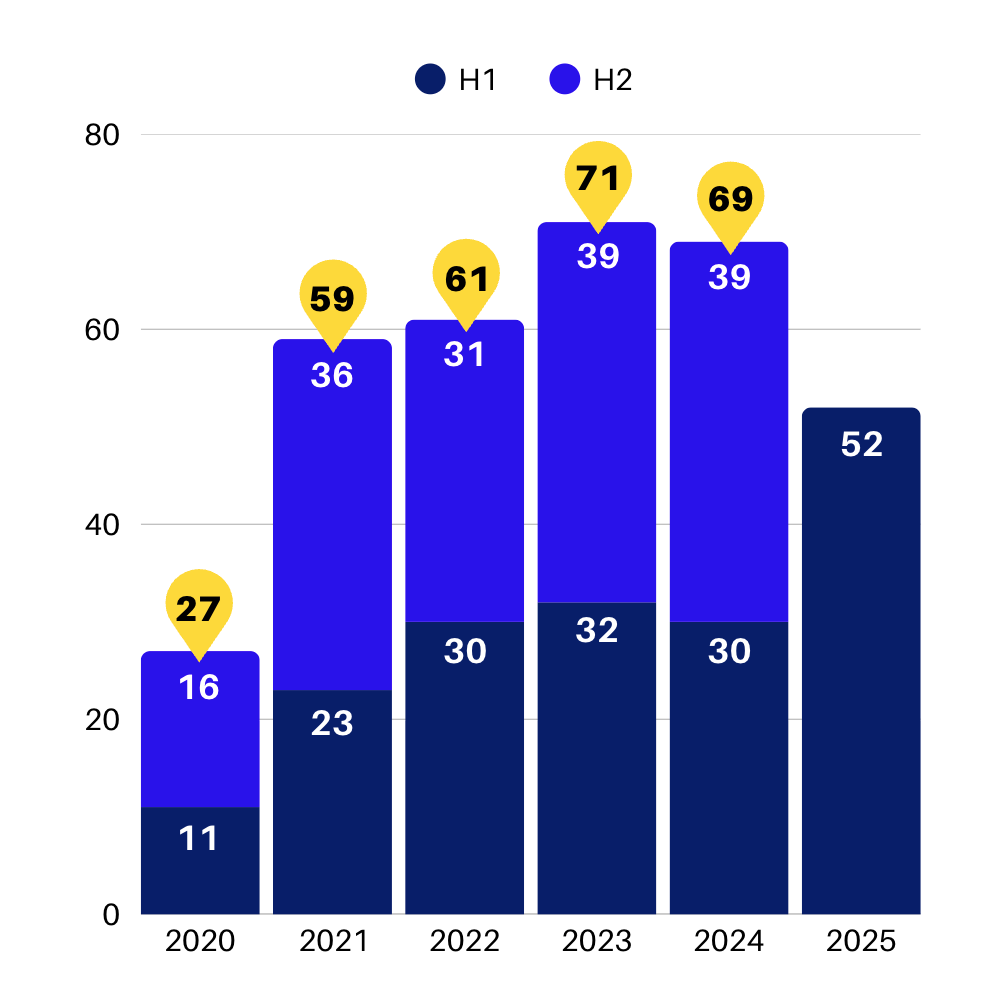

Transaction Volume: 52 M&A deals completed in the first half of 2025 (73% YoY increase).

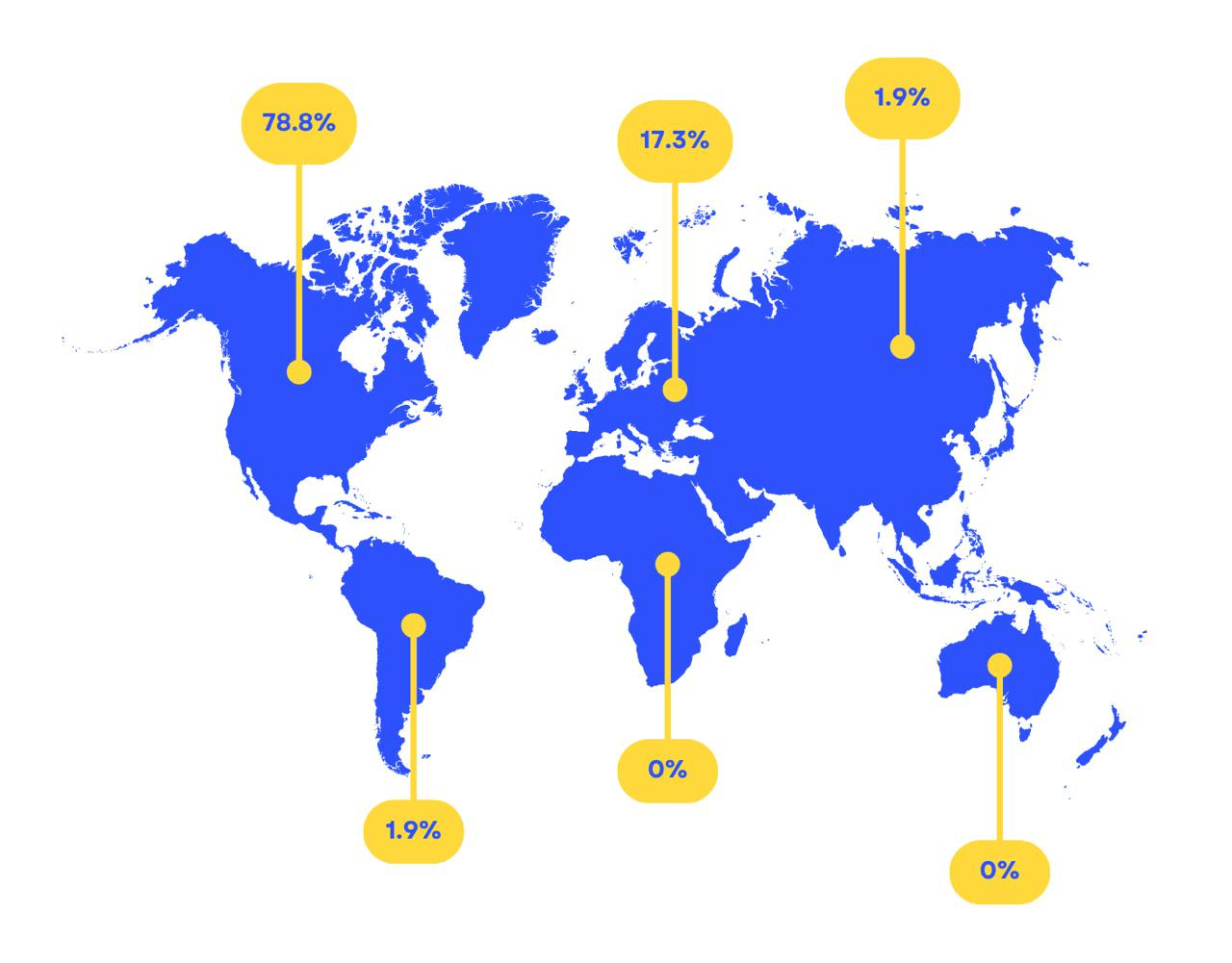

Market Leadership: North America dominates with 79% of transactions.

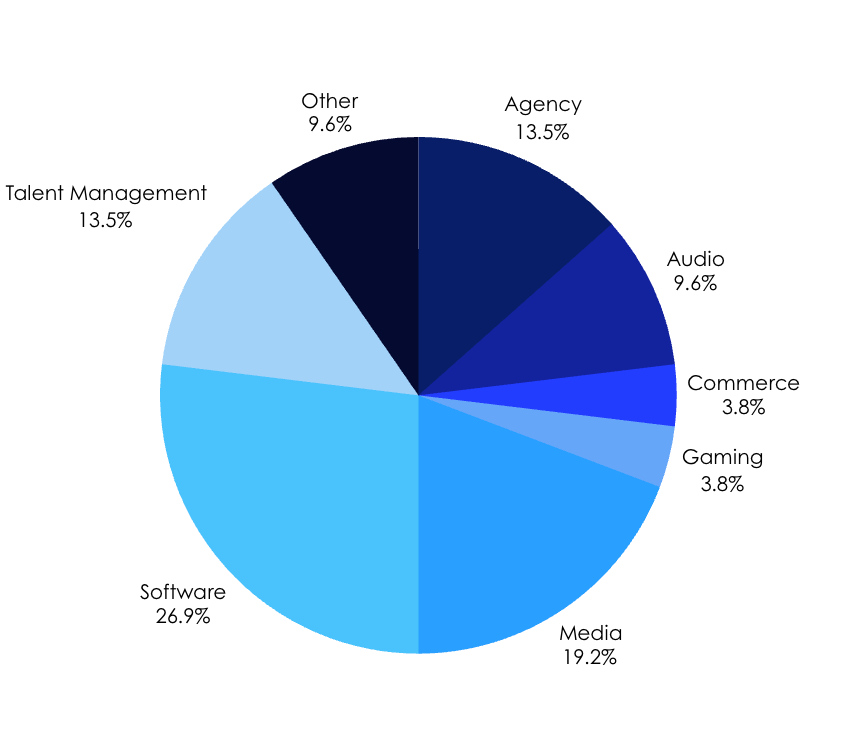

Sector Focus: Primary acquisition targets include software (27%), media companies (19%), agencies (14%), and talent management firms (14%).

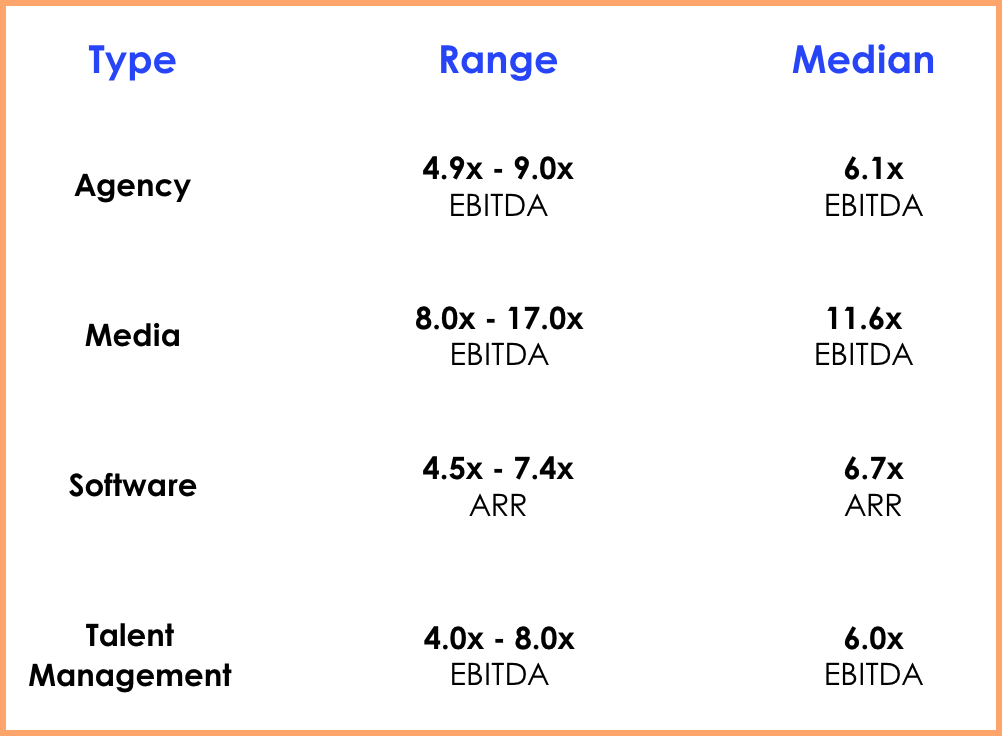

Valuation Range: Most creator economy companies are valued at 5x - 8x EBITDA.

KEY TRENDS

M&A activity is up 73% YoY.

Deal volume increased from 30 transactions in 2024 H1 to 52 transactions in 2025 H1, signaling strong interest and continued growth in the space.

Private equity firms are placing their bets.

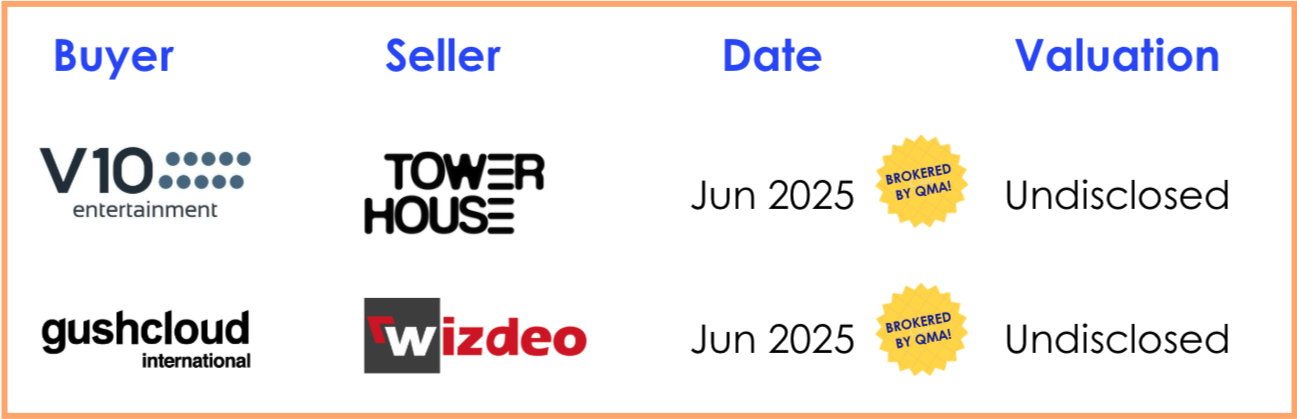

There’s been a flurry of growth equity investments and M&A activity from PE–backed companies in recent months, including PSG x Uscreen, Summit Partners-backed Later x Mavely, Eldridge-backed Fixated x Camp Talent & Moondust Management, Clarion Capital-backed V10 x Towerhouse, Blackrock-backed Epidemic Sound x Song Sleuth, and many more.

Non-endemic buyers are entering the space.

We’re starting to see strategic acquisitions from buyers outside the creator economy, including food delivery company Wonder’s acquisition of digital publisher Tastemade and sustainable clothing brand Sown Again’s acquisition of Noah Beck’s genderless underwear brand IPHIS.

International activity slowed down.

International targets accounted for 40.0% of M&A transactions in 2024 H1, which shrank to 21.2% in 2025 H1, as U.S. activity exploded.

2025 H1 DEAL VOLUME

M&A activity has surged in the first half of the year, positioning 2025 to set a new record for creator economy transactions.

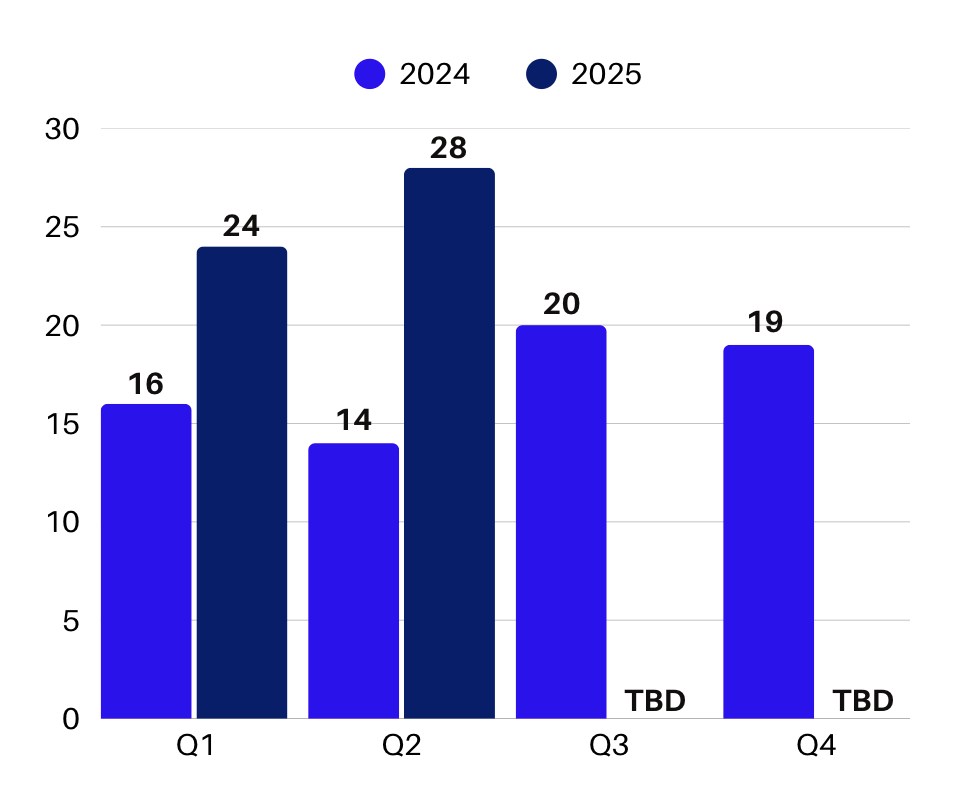

QUARTERLY DEAL VOLUME

Dealmaking activity experiences some seasonality, with most transactions announced in the second half of the year. It’s been a busy start to the year, so expect even more deals announced in H2.

LARGEST DEALS OF 2025 H1

Here are the largest transactions from the first half of the year.

TARGET PROFILES

Software companies are most in demand, accounting for over a quarter of all H1 2025 transactions. Media properties, agencies, and talent management firms are also highly sought, given continued consolidation in each of those categories.

GEOGRAPHIC DISTRIBUTION

North America dominated H1 transactions, with 78.8% of acquisition targets hailing from the U.S. Much of the remaining activity occurred in Europe, with a few isolated deals in South America and Asia.

VALUATION MULTIPLES

Software companies are typically valued on annual recurring revenue (ARR), while services businesses trade based on expectations of future earnings as measured by EBITDA.

Sources: FirstPageSage Jan 2025, Jahani & Associates Aug 2024, SaaS Capital Jan 2025, Development Corporate Mar 2025, Quartermast transactions and executive interviews.

TRANSACTION SUMMARIES

CREATOR SERVICES

Creator services remains a relatively underserved market segment, though we’re starting to see more interest and activity in the sector. We expect to see more such transactions in the next 12 - 18 months.

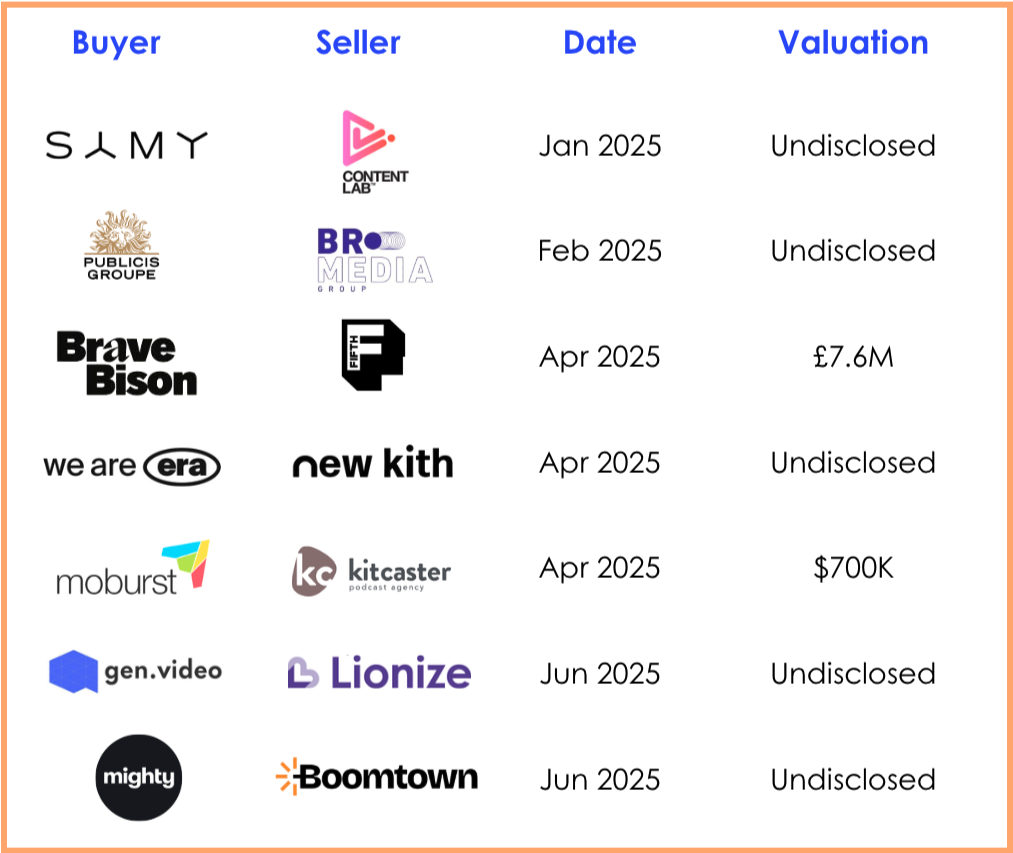

INFLUENCER MARKETING AGENCIES

Influencer marketing agencies remain in high demand, especially among traditional agency groups.

MEDIA

Buyers remain interested in media properties, including digital publishers, short-form video studios, and creator media companies.

SOFTWARE

Software is the most active categories for creator economy M&A, spanning influencer marketing platforms, content creation tools, and more.

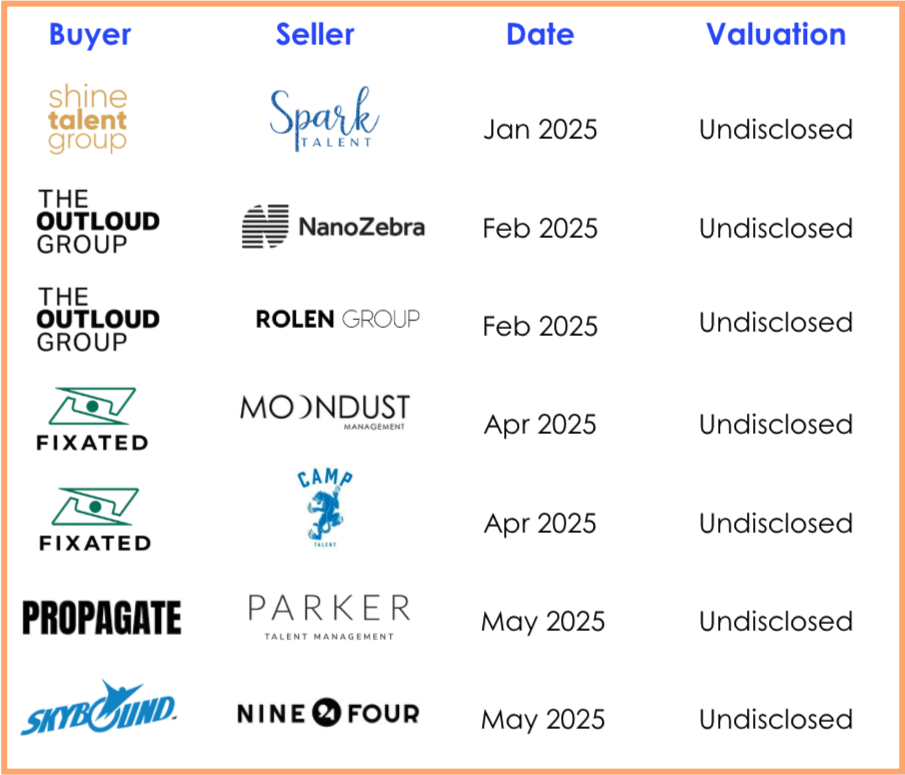

TALENT MANAGEMENT FIRMS

Market consolidation continues among talent representation businesses. M&A activity for this sector was fairly consistent YoY, so we anticipate more talent management acquisitions in H2.

If you enjoyed reading this edition, help sustain our work by clicking ❤️ and 🔄 at the top of this post.